Banks, Fintechs, and Digital Accounts in the U.S

How to Choose the Right Option for Your Money

Advertiser

The U.S. banking system has evolved rapidly over the past decade. Today, consumers can choose between traditional banks, online banks, and fintech-powered digital accounts, each offering different fees, features, and benefits.

Understanding how these options work can help you save money, avoid unnecessary fees, and manage your finances more efficiently.

In this article, we’ll cover:

- Traditional banks vs. digital banks

- What online banks and neobanks are

- How to choose the best bank in the U.S.

- Accounts with lower fees and better benefits

🏦 Traditional Banks vs. Digital Banks

Traditional Banks

Traditional banks operate physical branches and have been part of the U.S. financial system for decades.

Pros:

- In-person customer service

- Wide range of products (checking, savings, loans, mortgages)

- Familiar structure and brand trust

Cons:

- Higher monthly maintenance fees

- Lower interest rates on savings

- Strict balance requirements

Digital Banks

Digital banks operate primarily—or entirely—online and through mobile apps.

Pros:

- Lower or no monthly fees

- Higher interest rates on savings

- User-friendly apps and tools

Cons:

- No physical branches

- Limited cash deposit options

👉 Many consumers now use a hybrid approach, keeping a traditional bank for cash needs and a digital bank for savings.

💻 What Are Online Banks and Neobanks?

While often grouped together, online banks and neobanks are not exactly the same.

Online Banks

- Fully licensed banks

- FDIC insured

- Operate without physical branches

- Offer checking, savings, and sometimes loans

Neobanks (Fintechs)

- Technology-first financial platforms

- Often partner with licensed banks

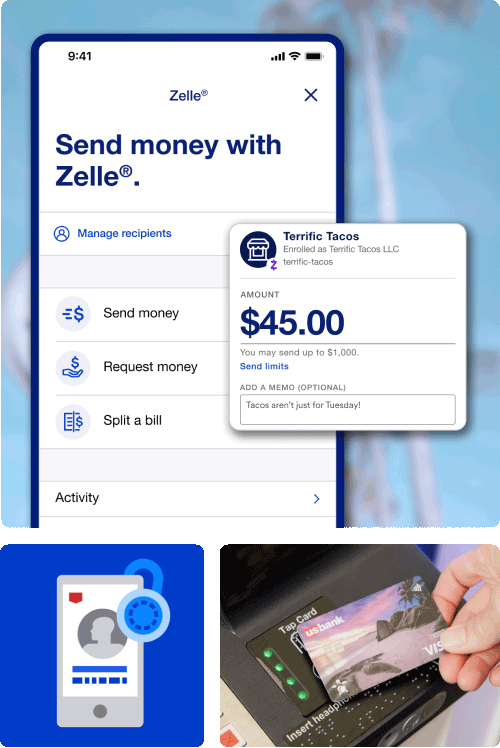

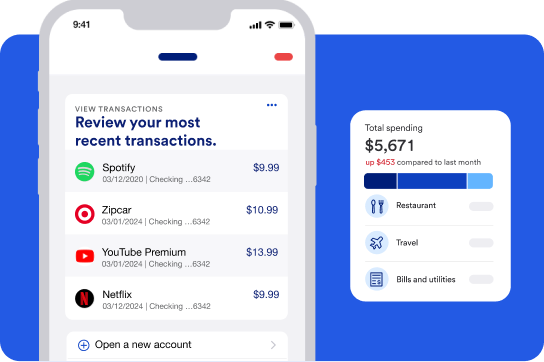

- Strong focus on user experience and automation

- May offer budgeting tools, early direct deposit, and fee-free accounts

👉 Both options appeal to users who value convenience, transparency, and lower costs.

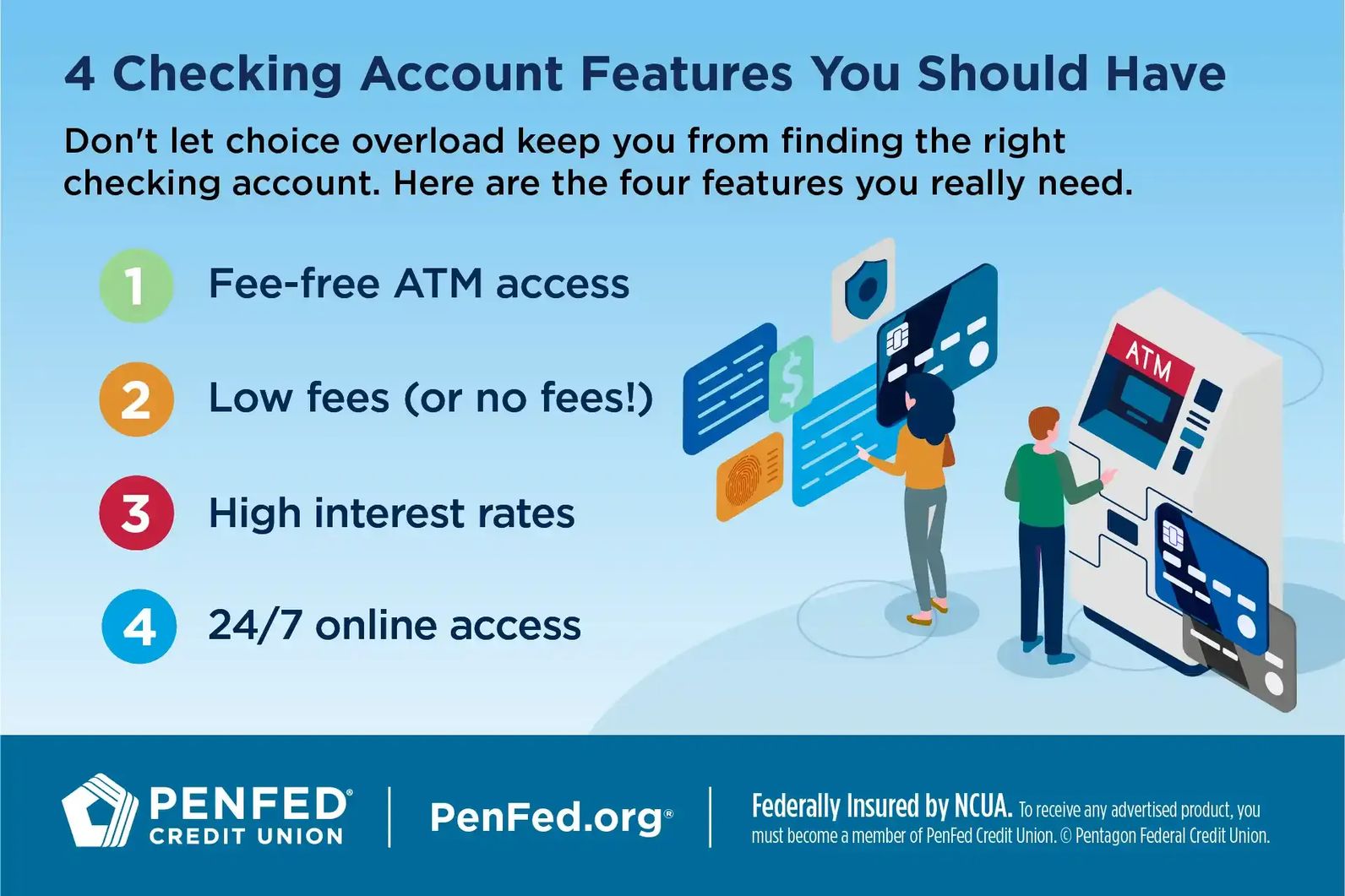

🧭 How to Choose the Best Bank in the U.S.

There’s no single “best” bank—only the best one for your financial needs.

Key factors to consider:

- Fees: monthly maintenance, overdraft, ATM fees

- Interest rates: especially on savings accounts

- ATM access: nationwide networks or reimbursements

- Mobile app quality

- Customer support availability

- FDIC insurance (critical for account safety)

👉 Always read the fee schedule before opening an account.

Read also: Taxes for Freelancers, Contractors, and Small Businesses

💸 Accounts with Lower Fees and Better Benefits

Many modern banking options are designed to reduce or eliminate common fees.

Features to look for:

- No monthly maintenance fees

- No minimum balance requirements

- Free or reimbursed ATM withdrawals

- High-yield savings options

- Early direct deposit

- Overdraft protection or grace periods

High-yield savings accounts offered by online banks often pay significantly more interest than traditional banks, making them ideal for emergency funds and short-term goals.

✅ Final Thoughts

Choosing the right bank in the U.S. can have a meaningful impact on your financial health. With more options than ever—traditional banks, online banks, and fintech platforms—consumers now have greater control over fees, interest, and convenience.

The best strategy is to match your banking setup to your lifestyle, minimize fees, and take advantage of digital tools that help you manage money smarter.