Budgeting and Money Management

How to Take Control of Your Finances in the U.S.

Advertiser

Budgeting isn’t about restriction—it’s about clarity and control. In the United States, where expenses can be unpredictable and many payments are automated, strong money management skills are essential for reducing stress, avoiding debt, and building long-term wealth.

In this article, you’ll learn:

- The best budgeting methods used in the U.S.

- How to track expenses effectively

- Popular budgeting apps and tools

- How to stick to a budget long term

📊 Best Budgeting Methods in the U.S.

There’s no one-size-fits-all budget. The best method is the one you can maintain consistently.

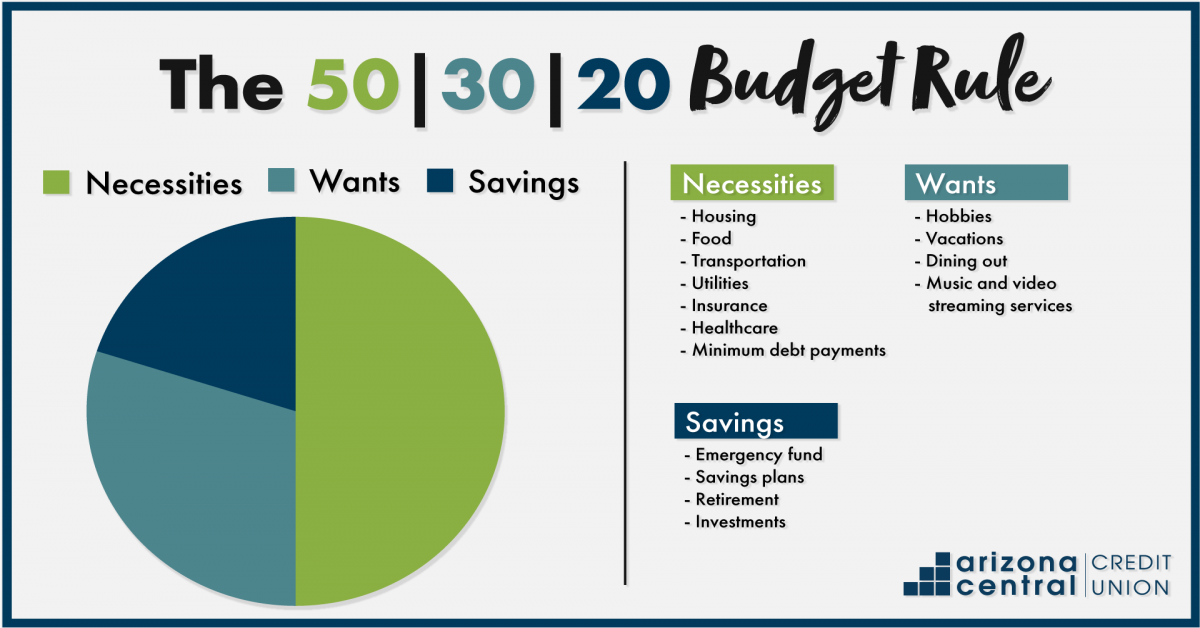

50/30/20 Budget

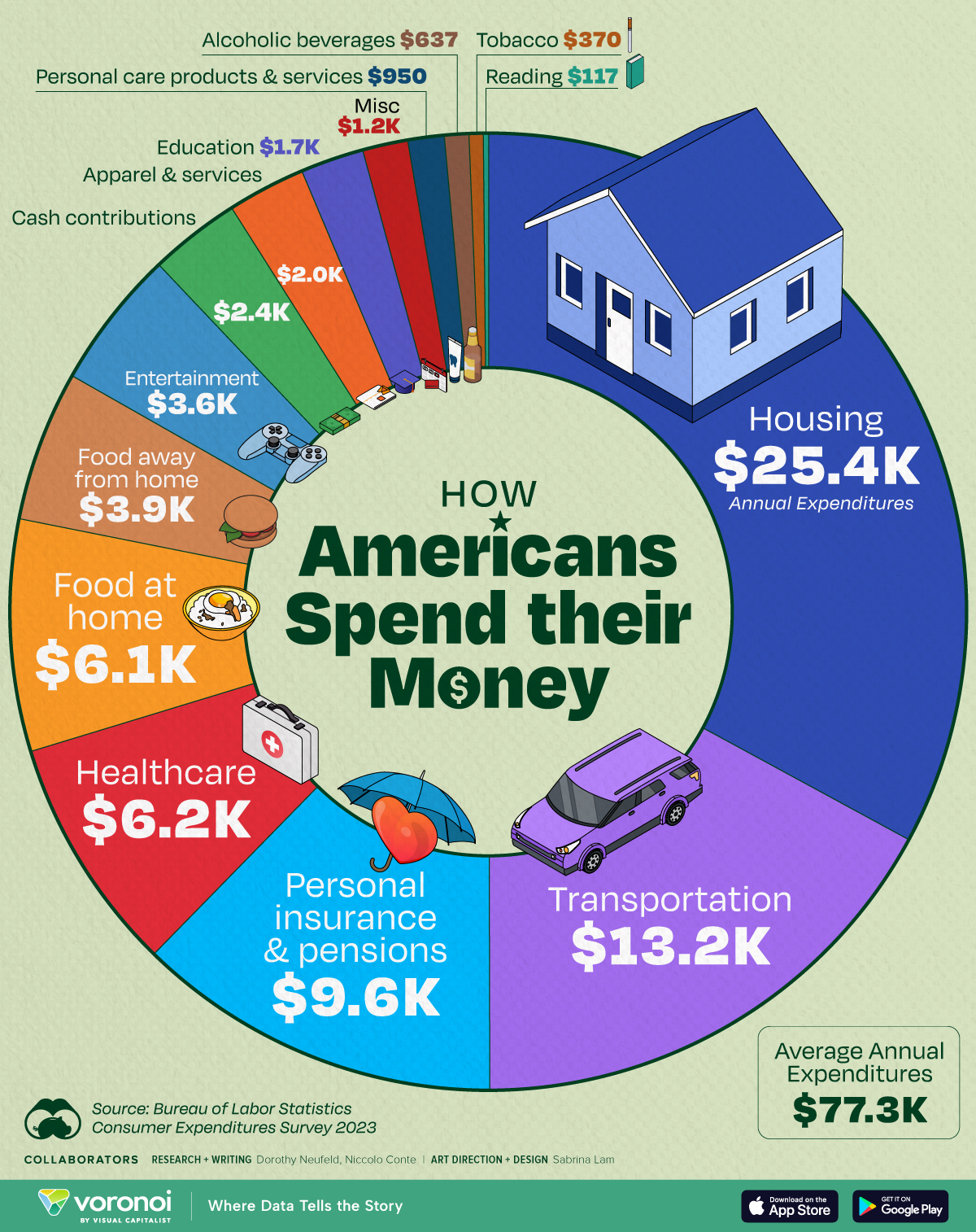

- 50% needs (housing, utilities, food, transportation)

- 30% wants (entertainment, dining out, hobbies)

- 20% savings and debt repayment

✅ Simple and beginner-friendly

❌ Less precise for aggressive financial goals

Zero-Based Budget

- Every dollar is assigned a purpose

- Income minus expenses equals zero

✅ High level of control

❌ Requires more time and discipline

Pay-Yourself-First Budget

- Savings and investments come first

- Remaining money covers expenses

✅ Great for long-term wealth building

❌ Requires predictable income

👉 Start simple. You can always adjust as your finances evolve.

🧾 How to Track Expenses Effectively

Tracking expenses is the foundation of successful budgeting. You can’t manage what you don’t measure.

Effective tracking strategies:

- Review bank and credit card statements monthly

- Categorize spending (housing, food, transport, subscriptions)

- Watch for recurring charges and forgotten subscriptions

- Track both fixed and variable expenses

👉 Even small daily purchases can quietly break a budget if left unchecked.

📱 Budgeting Apps and Tools Comparison

Budgeting apps make money management easier and more automated.

Common budgeting tools:

- Budgeting apps – Automatically categorize transactions

- Spreadsheets – Customizable and flexible

- Bank tools – Built-in spending insights

What to look for in a budgeting tool:

- Easy-to-use interface

- Clear spending categories

- Alerts for overspending

- Goal tracking features

👉 The best app is the one you’ll actually use consistently.

🔁 How to Stick to a Budget Long Term

Creating a budget is easy. Sticking to it is the real challenge.

Tips for long-term success:

- Set realistic spending limits

- Allow flexibility for lifestyle and fun

- Review and adjust your budget monthly

- Automate savings and bill payments

- Focus on progress, not perfection

👉 Budgeting is a habit, not a one-time task.

✅ Final Thoughts

Budgeting and money management are essential skills for financial success in the U.S. Whether your goal is to eliminate debt, build savings, or invest for the future, a clear budget gives you direction and confidence.

The key is consistency. Start where you are, choose a system that fits your lifestyle, and refine it over time.

Read also: Retirement and Financial Independence