Taxes for Freelancers, Contractors, and Small Businesses

What You Need to Know

Advertiser

Working for yourself in the United States—whether as a freelancer, independent contractor, or small business owner—offers flexibility and income potential. But it also comes with tax responsibilities that employees don’t face.

Understanding how taxes work for self-employed individuals is essential to avoid surprises, penalties, and cash-flow problems.

In this guide, you’ll learn:

- How quarterly estimated taxes work

- Common tax deductions for freelancers and self-employed workers

- How to avoid IRS penalties

- The best tax tools and software for small businesses

🧾 Quarterly Estimated Taxes Explained

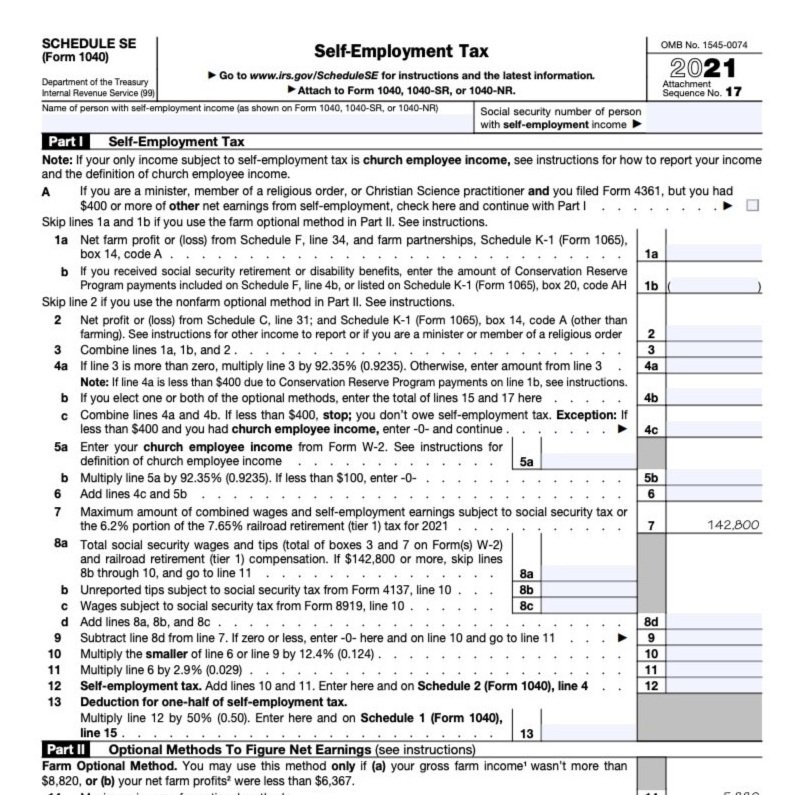

Unlike employees, freelancers and contractors don’t have taxes automatically withheld from their income. Instead, they must pay estimated taxes quarterly.

What are estimated taxes?

Estimated taxes are payments made to the IRS throughout the year to cover:

- Federal income tax

- Self-employment tax (Social Security + Medicare)

- State taxes (if applicable)

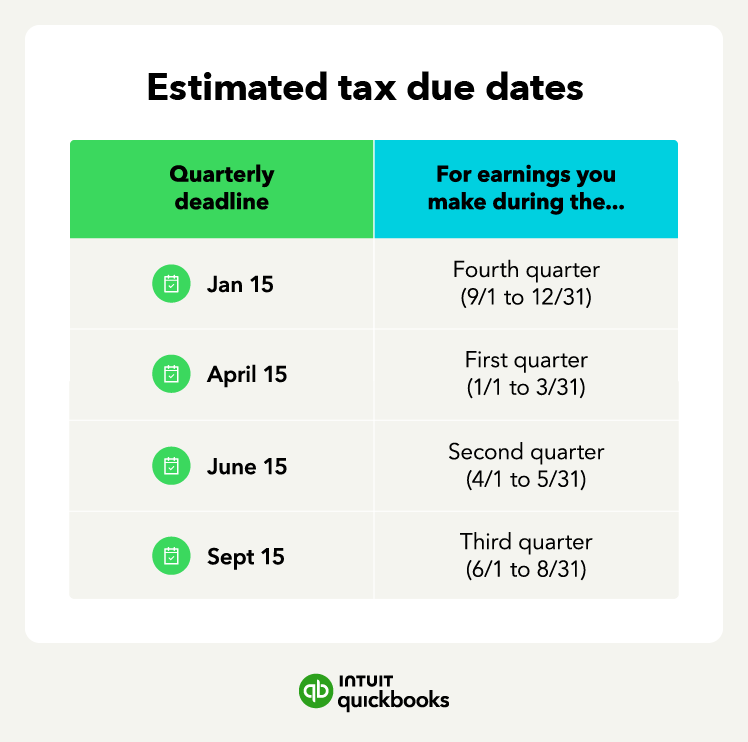

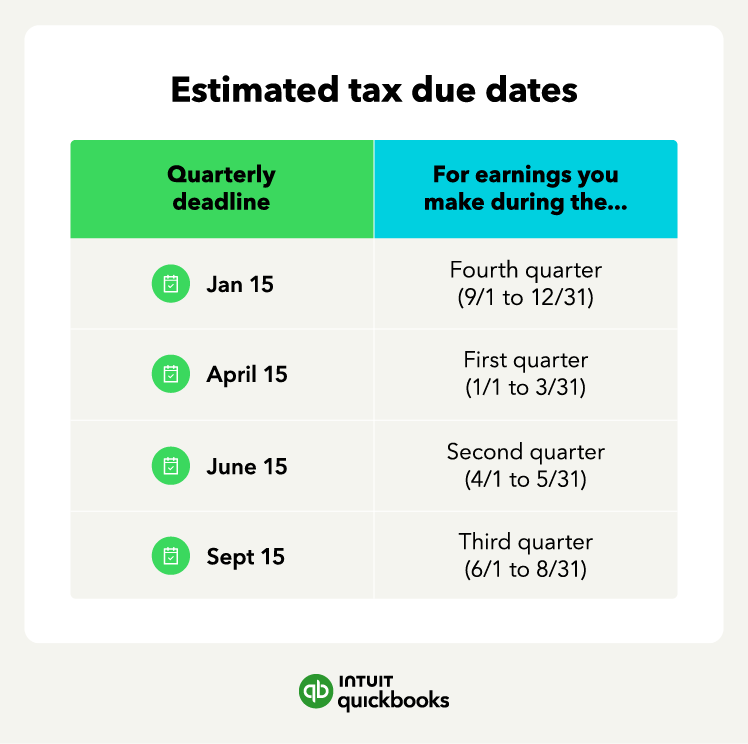

When are payments due?

Estimated taxes are typically due:

- April

- June

- September

- January (of the following year)

👉 Missing or underpaying estimated taxes can result in penalties and interest—even if you pay everything later.

💸 Tax Deductions for Freelancers and Self-Employed Workers

One of the biggest advantages of self-employment is access to tax deductions that reduce taxable income.

Common deductions include:

Home office expenses

- Internet and phone bills (business portion)

- Business software and subscriptions

- Office supplies and equipment

- Marketing and advertising costs

- Health insurance premiums (if eligible)

- Mileage and vehicle expenses

👉 The key rule: expenses must be ordinary and necessary for your business.

Good recordkeeping is essential to claim deductions safely.

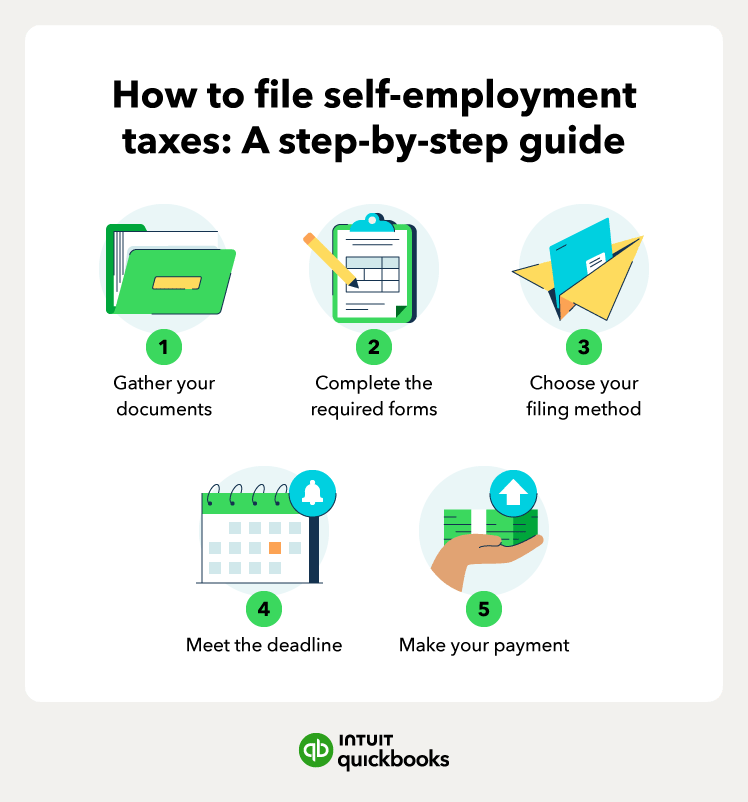

🚫 How to Avoid IRS Penalties

Many tax problems come from simple mistakes—not intentional wrongdoing.

How to stay compliant:

- Pay estimated taxes on time

- Set aside 25–30% of income for taxes

- Keep receipts and documentation

- Separate personal and business finances

- File accurate and complete tax returns

👉 Ignoring taxes doesn’t make them go away—it makes them more expensive.

🧮 Best Tax Tools and Software for Small Businesses

Tax software can simplify compliance and reduce errors—especially for solo entrepreneurs.

Useful tools typically offer:

- Income and expense tracking

- Estimated tax calculations

- Deduction guidance

- Integration with bank accounts

- Easy tax filing or export to a CPA

Who should use software vs. an accountant?

- Solo freelancers often benefit from software

- Growing businesses may need professional tax advice

👉 The right tool saves time, stress, and money.

✅ Final Thoughts

Taxes are one of the biggest challenges of freelancing and running a small business—but they don’t have to be overwhelming. With proper planning, consistent saving, and the right tools, you can stay compliant and protect your income.

Understanding your tax obligations is not just about avoiding penalties—it’s about building a sustainable and profitable business.