Sustainable and ESG Investing

How to Align Your Money With Your Values Without Sacrificing Returns

Advertiser

Investing has traditionally focused on one primary goal: maximizing financial returns. But for a growing number of investors in the United States, how money is invested matters just as much as how much it earns. This shift has driven the rapid growth of sustainable and ESG investing.

ESG investing allows individuals to consider environmental, social, and governance factors alongside financial performance. It’s not about charity or sacrificing returns—it’s about understanding risks, opportunities, and long-term impact in a changing global economy.

In this article, you’ll learn:

- What ESG investing really means

- The difference between impact investing and traditional investing

- Common performance myths around sustainable investing

- How to align your investments with your personal values

🌱 What ESG Investing Means

ESG stands for Environmental, Social, and Governance—three categories used to evaluate how companies operate beyond their financial statements.

Environmental factors may include:

- Climate impact and carbon emissions

- Energy efficiency and renewable energy use

- Waste management and resource conservation

Social factors often examine:

- Employee treatment and workplace safety

- Diversity, equity, and inclusion

- Customer protection and community impact

- Supply chain labor practices

Governance factors focus on:

- Corporate leadership and board structure

- Executive compensation

- Shareholder rights

- Transparency and ethical business practices

ESG investing integrates these factors into investment analysis to assess long-term sustainability and risk, not just short-term profits.

👉 ESG is not a political label—it’s a framework for evaluating how companies manage long-term challenges.

⚖️ Impact Investing vs. Traditional Investing

While often grouped together, impact investing and traditional investing serve different purposes.

Traditional investing

Traditional investing prioritizes:

- Financial return

- Risk management

- Market performance

Environmental or social outcomes may occur, but they are not the primary objective.

Impact investing

Impact investing intentionally seeks:

- Measurable positive social or environmental outcomes

- Alongside financial returns

Examples include:

- Clean energy projects

- Affordable housing initiatives

- Healthcare access programs

- Community development funds

Key differences:

- Impact investing is outcome-driven

- ESG investing is often risk- and process-driven

- Traditional investing focuses primarily on financial metrics

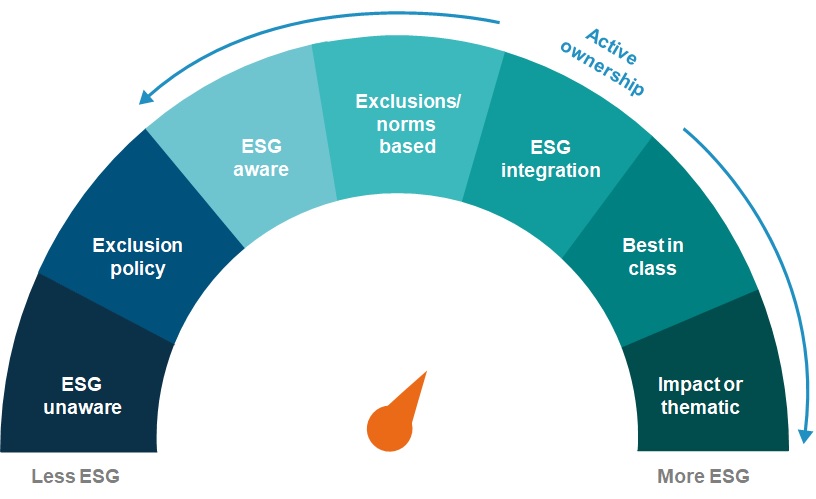

👉 ESG investing sits between traditional investing and impact investing, blending financial goals with broader responsibility.

📉 Performance Myths Around Sustainable Investing

One of the biggest misconceptions about ESG investing is that it requires sacrificing returns. This belief has discouraged many investors from exploring sustainable strategies.

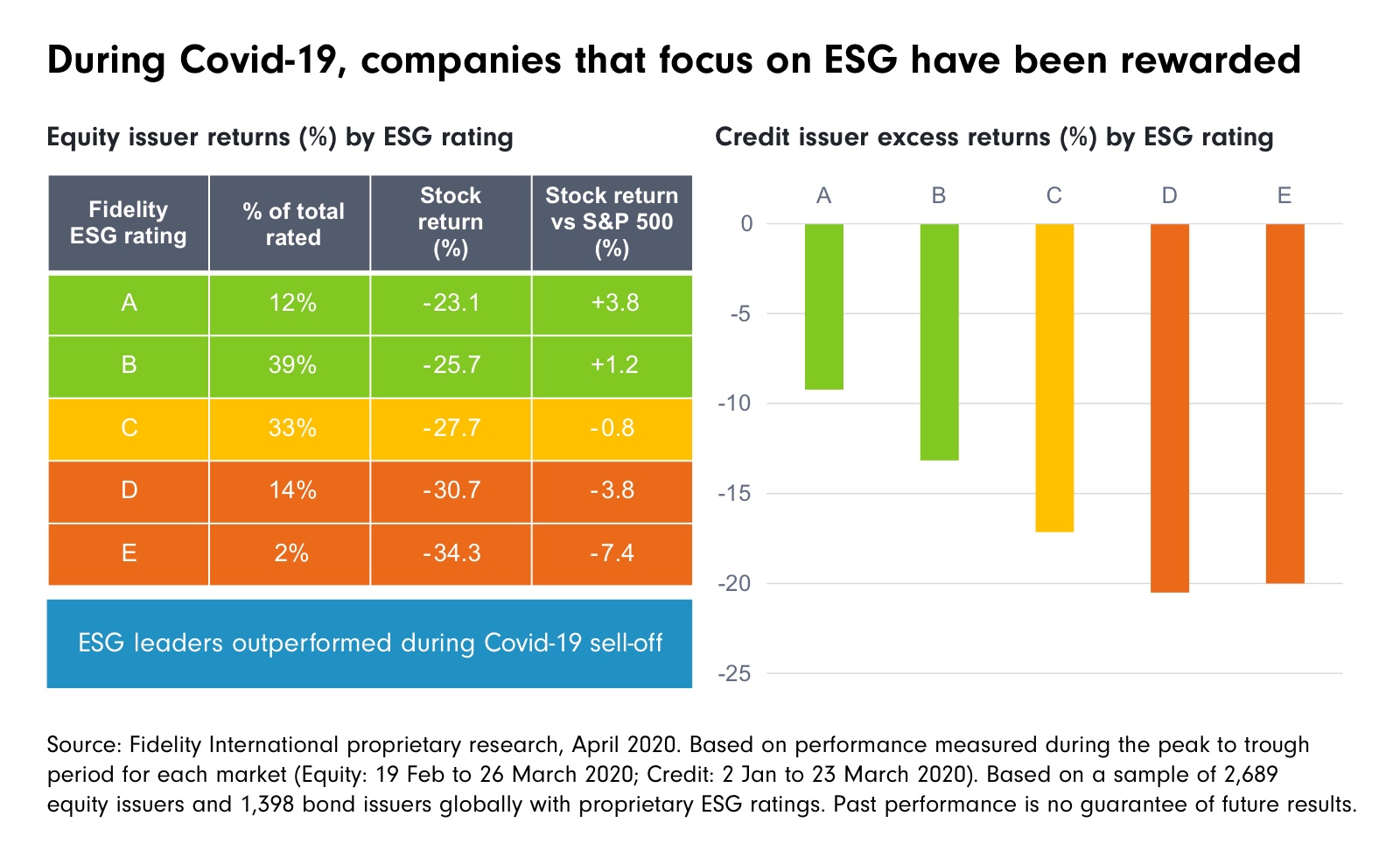

Myth #1: ESG investing always underperforms

Reality: Numerous studies show that ESG investments often perform in line with—or sometimes better than—traditional investments, especially over long periods.

Companies with strong ESG practices may:

- Manage risks more effectively

- Avoid costly scandals or regulatory penalties

- Adapt faster to changing regulations and consumer preferences

Myth #2: ESG investing is only for idealists

Reality: ESG investing has become mainstream. Major institutional investors, pension funds, and asset managers now integrate ESG analysis as part of standard risk assessment.

Myth #3: ESG portfolios lack diversification

Reality: ESG options exist across:

- Stocks and bonds

- Domestic and international markets

- Index funds and actively managed funds

👉 Sustainable investing is no longer niche—it’s a core part of modern portfolio construction.

📊 Risk, Resilience, and Long-Term Performance

One of the strongest arguments for ESG investing is its focus on long-term risk management.

Companies that ignore environmental or social risks may face:

- Regulatory fines

- Reputational damage

- Operational disruptions

- Talent retention challenges

Governance failures, in particular, have historically led to major financial losses for investors.

By incorporating ESG factors, investors may gain better insight into:

- Corporate resilience

- Operational quality

- Management effectiveness

👉 ESG investing is often less about beating the market and more about avoiding unnecessary risks.

🧭 Aligning Investments With Personal Values

For many investors, ESG investing is also about personal alignment—knowing that their money supports practices they believe in.

Common values-based approaches include:

- Avoiding certain industries (e.g., tobacco, weapons)

- Supporting environmental sustainability

- Promoting social equity and fair labor practices

- Encouraging ethical corporate governance

Questions to ask yourself:

- What issues matter most to me?

- Am I more focused on exclusion or positive impact?

- How much flexibility do I want in defining “sustainable”?

There is no single “right” ESG portfolio—only what aligns best with your priorities.

👉 Investing with values doesn’t require perfection—just intention.

🔍 Greenwashing and ESG Due Diligence

As ESG investing has grown, so has greenwashing—when companies or funds exaggerate their sustainability claims.

How to evaluate ESG investments:

- Review fund holdings and methodologies

- Understand ESG scoring criteria

- Look for transparency and third-party data

- Avoid relying solely on marketing labels

Not all ESG funds apply the same standards. Some exclude certain industries, while others focus on best-in-class performers within each sector.

👉 Due diligence is just as important in ESG investing as in traditional investing.

🧠 ESG Investing as Part of a Balanced Financial Plan

ESG investing works best when integrated into a broader financial plan, not treated as a separate or emotional decision.

A balanced approach includes:

- Clear financial goals

- Diversified asset allocation

- Appropriate risk tolerance

- Long-term time horizon

ESG investing should support—not replace—sound investment principles.

👉 Values and discipline can coexist in a well-constructed portfolio.

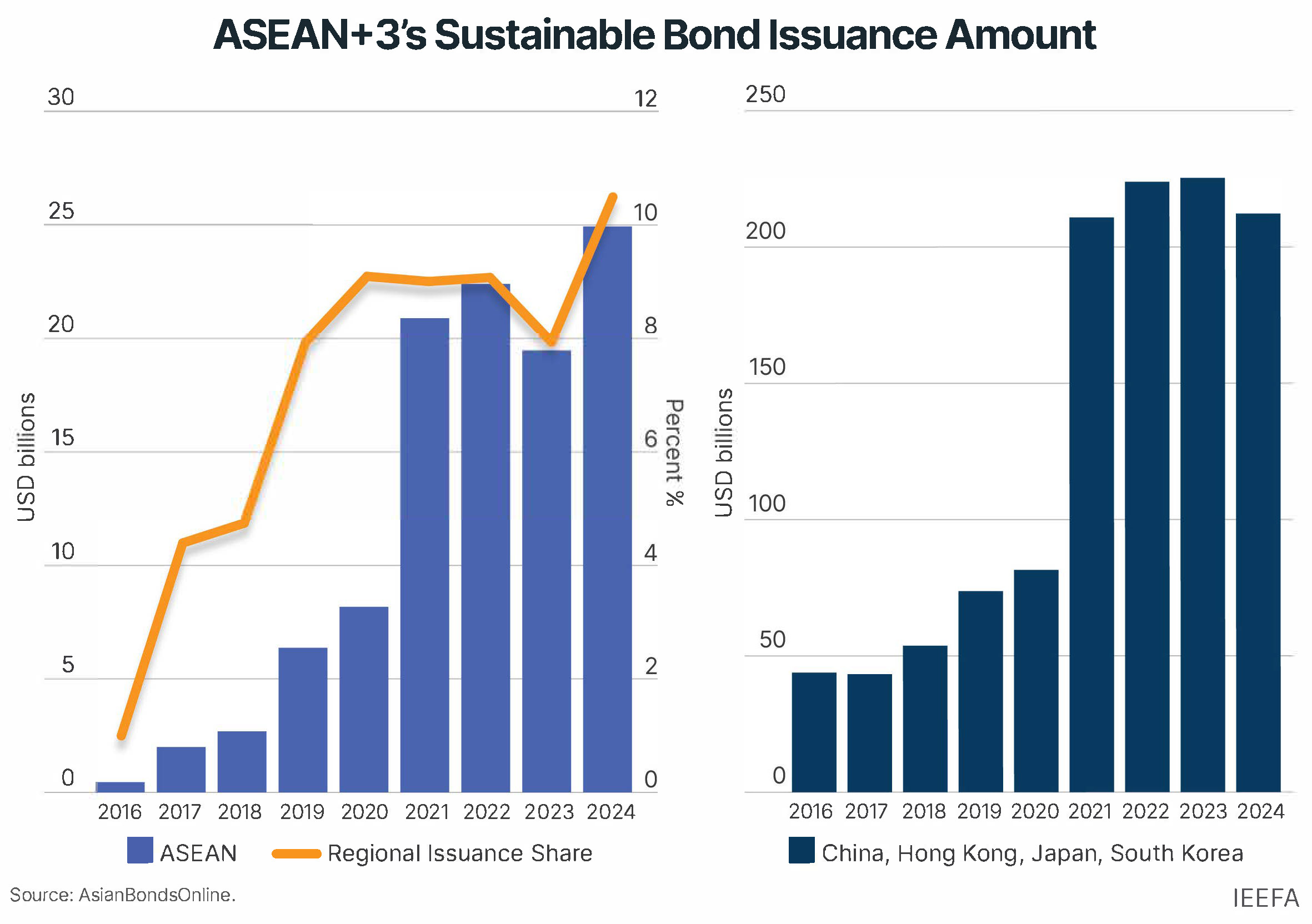

🌍 The Future of Sustainable Investing

As climate risks, demographic shifts, and regulatory changes accelerate, ESG considerations are becoming increasingly relevant to financial markets.

Trends shaping the future include:

- Greater transparency and reporting standards

- Increased regulation and disclosure requirements

- Growing demand from younger investors

- Integration of ESG data into mainstream analysis

Sustainable investing is evolving from an optional preference into a core investment lens.

✅ Final Thoughts

Sustainable and ESG investing is not about choosing between values and returns—it’s about understanding that long-term financial success depends on how companies manage environmental, social, and governance risks.

By learning what ESG investing truly means, separating myths from reality, and aligning investments with personal values thoughtfully, investors can build portfolios that reflect both financial goals and broader responsibility.

Your investments shape more than your future—they influence the world you retire into.

Sustainable investing isn’t about perfection.

It’s about intentional ownership.