Mental Health, Stress, and Money Management

How to Build Financial Stability Without Burning Out

Advertiser

Money is one of the most common sources of stress in modern life. Whether it’s paying bills, managing debt, worrying about retirement, or coping with unexpected expenses, financial pressure can quietly affect mental health, relationships, and overall well-being.

Personal finance is not just about numbers—it’s deeply emotional. Understanding the connection between money and mental health is essential for building not only financial stability, but also peace of mind. The goal isn’t to eliminate stress entirely, but to create systems that reduce uncertainty, increase confidence, and support healthier decisions over time.

In this article, you’ll learn:

- How financial stress affects mental health

- How to break the cycle of money anxiety

- Ways to build confidence around money decisions

- How to create financial systems that reduce stress

🧠 How Financial Stress Affects Mental Health

Financial stress doesn’t stay contained in your bank account—it often spills into every area of life.

Common mental health effects of financial stress:

- Chronic anxiety or worry

- Sleep problems

- Difficulty concentrating

- Feelings of shame or guilt

- Irritability or emotional withdrawal

For many people, money stress creates a constant background noise that makes it hard to relax, plan, or enjoy daily life. This stress can be even more intense during periods of job instability, inflation, debt accumulation, or major life changes.

Check out this content now: Identity Theft, Fraud Prevention, and Financial Security

Why money stress feels so overwhelming:

- Money is tied to safety and survival

- Financial problems often feel personal and isolating

- There’s social pressure to “have it together”

- Financial uncertainty reduces a sense of control

👉 Financial stress is not a personal failure—it’s a human response to uncertainty.

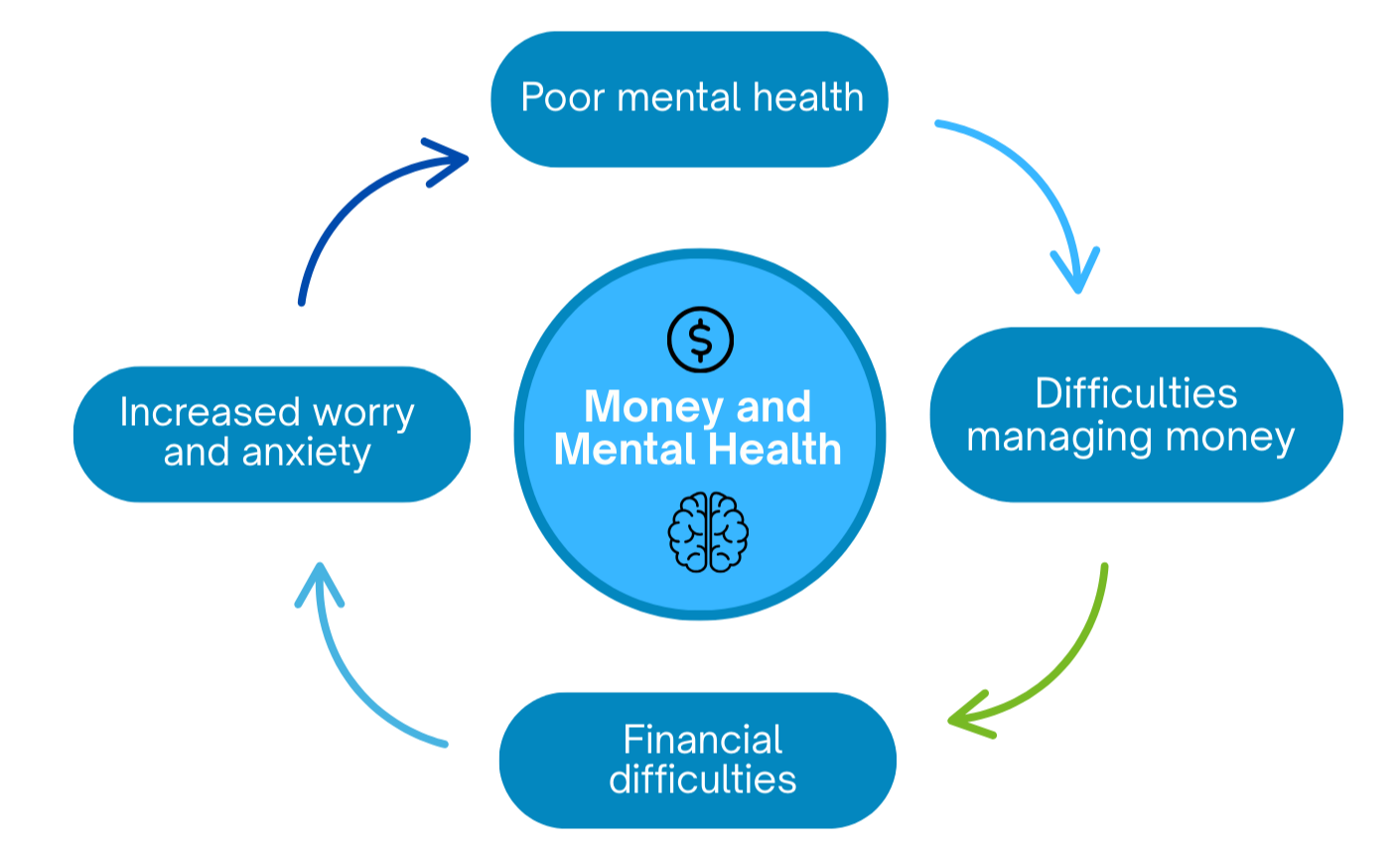

🔄 Breaking the Cycle of Money Anxiety

Money anxiety often creates a self-reinforcing cycle. Stress leads to avoidance, avoidance leads to lack of clarity, and lack of clarity increases stress.

Common money-anxiety behaviors:

- Avoiding bank statements or bills

- Delaying financial decisions

- Overchecking accounts compulsively

- Emotional spending to cope with stress

- Feeling frozen or overwhelmed by finances

Breaking this cycle doesn’t require drastic action—it requires small, consistent steps.

Practical ways to interrupt money anxiety:

- Schedule short, regular money check-ins

- Focus on one task at a time

- Replace avoidance with structure

- Separate emotions from immediate actions

- Seek information instead of assumptions

👉 Clarity reduces anxiety—even when the numbers aren’t perfect.

💪 Building Confidence Around Money Decisions

Many people struggle not because they lack financial knowledge, but because they lack confidence in their decisions.

Why financial confidence breaks down:

- Past mistakes create fear of repeating them

- Conflicting advice causes paralysis

- Comparing finances to others increases doubt

- Lack of experience leads to second-guessing

Confidence doesn’t come from never making mistakes—it comes from learning how to recover and adapt.

Ways to build financial confidence:

- Start with small, low-risk decisions

- Track progress instead of perfection

- Educate yourself gradually

- Acknowledge wins, no matter how small

- Focus on long-term direction, not daily fluctuations

Over time, repeated positive experiences create trust in your ability to manage money—even during uncertainty.

👉 Financial confidence is built through practice, not perfection.

🧾 Creating Financial Systems That Reduce Stress

One of the most effective ways to reduce money-related stress is to remove constant decision-making from your daily life. This is where financial systems matter.

Key systems that reduce mental load:

1. Automation

- Automatic bill payments

- Automatic savings contributions

- Automatic retirement investing

Automation ensures progress even when motivation is low.

2. Clear separation of accounts

- Checking for spending

- Savings for emergencies

- Separate accounts for goals

This clarity reduces confusion and emotional spending.

3. Simple budgeting frameworks

Complex budgets increase stress. Simple systems are easier to maintain and less emotionally draining.

4. Emergency buffers

Emergency funds reduce fear by creating margin between you and financial shocks.

👉 Systems protect you on days when motivation or emotional energy is low.

🧠 The Emotional Side of Spending

Spending is often emotional, not logical. People spend to cope with:

- Stress

- Loneliness

- Boredom

- Celebration

- Fatigue

This doesn’t make someone irresponsible—it makes them human.

Healthier alternatives to emotional spending:

- Identify emotional triggers

- Delay purchases by 24 hours

- Replace spending with non-financial rewards

- Budget guilt-free spending intentionally

Suppressing emotions doesn’t work. Designing spending with emotional awareness does.

👉 Awareness—not restriction—is the key to healthier spending habits.

🔄 Money Conversations and Mental Health

Avoiding money conversations often increases stress, especially in relationships.

Healthy money communication includes:

- Sharing concerns without blame

- Being honest about limitations

- Aligning financial priorities

- Normalizing uncertainty

Silence around money can increase anxiety, while open conversations often reduce it—even when finances are tight.

👉 Talking about money is a stress-reduction tool, not a conflict trigger.

🧠 Perfectionism, Shame, and Money

Perfectionism and shame are major drivers of money stress.

Common thoughts include:

- “I should be further ahead.”

- “Everyone else is doing better.”

- “I messed up, so why try?”

These beliefs often prevent action and reinforce anxiety.

Healthier mindset shifts:

- Progress matters more than comparison

- Financial paths are not linear

- Mistakes are part of learning

- Improvement is always possible

👉 Shame shuts down progress. Compassion opens the door to change.

🛡️ Financial Stability as Emotional Safety

Financial stability doesn’t mean unlimited money—it means predictability and margin.

Stability includes:

- Having emergency reserves

- Understanding your financial baseline

- Having a plan, even if imperfect

These factors significantly reduce chronic stress, even when income is modest.

👉 Stability is about control and preparedness, not wealth.

🔄 When to Seek Support

Sometimes money stress becomes overwhelming and requires support.

Support may include:

- Financial education or coaching

- Working with a financial planner

- Mental health counseling

- Financial therapy

There is no weakness in seeking help—only self-awareness.

👉 Financial health and mental health are connected. Treating them together leads to better outcomes.

✅ Final Thoughts

Money management is not just a financial skill—it’s an emotional one. Financial stress can affect mental health, decision-making, and quality of life, but it doesn’t have to control your future.

By understanding how money stress works, breaking cycles of anxiety, building confidence gradually, and creating systems that reduce decision fatigue, you can build a healthier relationship with money.

The goal isn’t to eliminate all financial stress.

It’s to create clarity, confidence, and resilience—even during uncertainty.

You don’t need perfect finances to feel better.

You need structure, self-trust, and compassion.