Behavioral Finance and Decision-Making Biases

Why Smart People Make Bad Money Decisions

Advertiser

Personal finance is often presented as a numbers game—budgets, interest rates, returns, and spreadsheets. But in reality, money decisions are deeply emotional and psychological. This is where behavioral finance comes in.

Behavioral finance studies how human behavior, emotions, and cognitive biases influence financial decisions. It explains why people panic-sell during market crashes, overspend despite good intentions, or stick with bad investments longer than they should.

Understanding these behavioral patterns is one of the most powerful tools you can use to improve your financial outcomes—not by becoming smarter, but by becoming more disciplined and self-aware.

In this article, you’ll learn:

- The most common cognitive biases that affect money decisions

- How emotions influence investing and market behavior

- How to build discipline in financial decision-making

- How to avoid common behavioral finance traps

🧠 Cognitive Biases That Affect Money Decisions

Cognitive biases are mental shortcuts the brain uses to process information quickly. While helpful in daily life, they often lead to systematic financial mistakes.

Common financial cognitive biases:

Confirmation bias

People seek information that confirms what they already believe and ignore evidence that contradicts it. Investors may only read news that supports their investment choices.

Loss aversion

Losses feel more painful than gains feel good. This often causes people to hold losing investments too long or avoid investing altogether.

Overconfidence bias

Many individuals overestimate their ability to predict markets or manage money, leading to excessive trading or risk-taking.

Anchoring bias

Decisions are influenced by an initial reference point, such as the price you paid for a stock—even when that price is no longer relevant.

Recency bias

People give too much weight to recent events, assuming recent trends will continue indefinitely.

👉 These biases affect everyone, regardless of intelligence or experience.

📉 Emotional Investing and Market Behavior

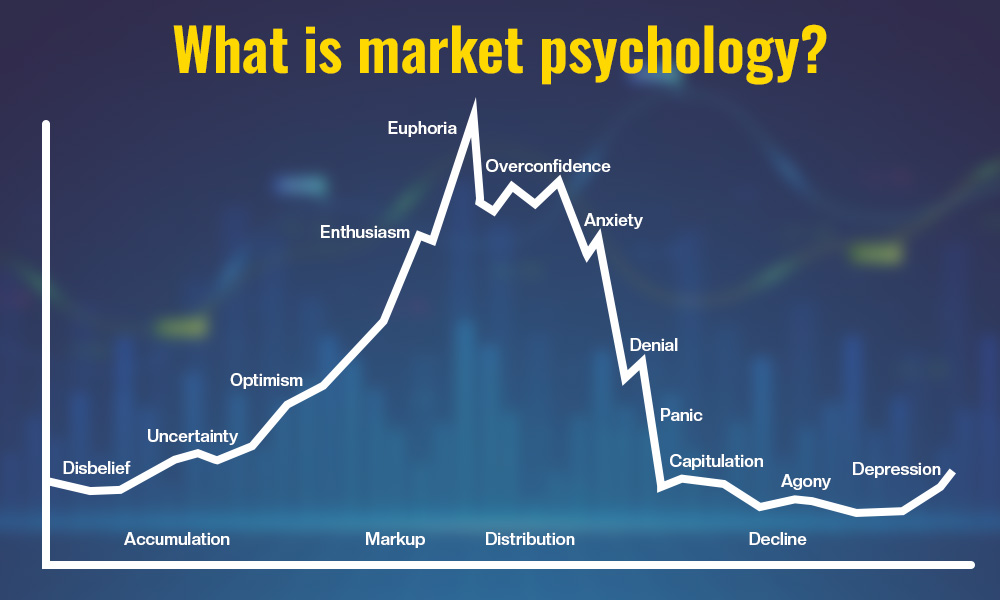

Financial markets are driven as much by human emotion as by fundamentals. Fear and greed shape market cycles and investor behavior.

How emotions affect investing:

Fear during downturns

Market declines trigger panic, causing investors to sell at the worst possible times—often locking in losses.

Greed during bull markets

Rising markets can lead to overconfidence, speculation, and chasing “hot” investments at inflated prices.

Herd behavior

People tend to follow the crowd, assuming others must know something they don’t. This fuels bubbles and crashes.

Regret avoidance

Fear of making a wrong decision leads to inaction, causing missed opportunities or delayed investing.

👉 Emotional investing is one of the biggest reasons individual investors underperform the market over time.

🧱 How to Build Discipline in Financial Decision-Making

Discipline—not intelligence—is the most important factor in long-term financial success.

Practical ways to build discipline:

1. Create rules before emotions take over

Set investing and spending rules in advance, such as:

- Asset allocation targets

- Rebalancing schedules

- Savings percentages

Rules reduce emotional decision-making.

2. Automate good behavior

Automation removes temptation and inconsistency:

- Automatic savings

- Automatic retirement contributions

- Automatic bill payments

3. Focus on process, not outcomes

You can’t control markets, but you can control behavior. Good decisions don’t always lead to good short-term outcomes—and bad outcomes don’t always mean bad decisions.

4. Limit noise and overconsumption of financial news

Constant market updates increase anxiety and emotional reactions.

👉 Discipline turns good intentions into consistent action.

⚠️ Avoiding Common Behavioral Finance Traps

Recognizing behavioral traps helps you avoid repeating costly mistakes.

Common traps to watch out for:

❌ Market timing – Trying to predict short-term market movements

❌ Performance chasing – Investing in assets after they’ve already performed well

❌ Panic selling – Selling during downturns due to fear

❌ Overtrading – Frequent buying and selling driven by emotion

❌ Ignoring long-term goals – Letting short-term volatility derail plans

The most damaging mistakes often occur during periods of high emotion and uncertainty.

👉 Doing nothing is often better than doing something emotional.

🧠 The Role of Self-Awareness in Financial Success

Improving financial behavior starts with understanding your own tendencies.

Ask yourself:

- Do I react emotionally to market news?

- Do I avoid looking at finances during stress?

- Do I overspend when anxious or celebratory?

- Do I struggle more with fear or overconfidence?

There’s no “perfect” investor or spender. The goal is to design systems that work with your psychology, not against it.

🔄 Long-Term Thinking vs. Short-Term Emotion

Behavioral finance teaches us that long-term success often comes from ignoring short-term impulses.

Long-term thinkers:

- Accept market volatility

- Stay invested during downturns

- Stick to plans despite discomfort

- Adjust strategies thoughtfully, not reactively

Short-term emotional decisions often feel urgent—but rarely improve outcomes.

👉 Time and patience reward disciplined behavior.

🛡️ Using Behavioral Finance to Improve Your Financial Plan

Smart financial plans account for human behavior, not just math.

Examples include:

- Conservative assumptions to reduce panic

- Emergency funds to prevent forced selling

- Simple portfolios to reduce overthinking

- Written plans to guide decisions during stress

A plan that looks good on paper but fails under pressure isn’t a good plan.

✅ Final Thoughts

Behavioral finance explains a simple truth: money decisions are human decisions. Emotions, biases, and habits influence financial outcomes just as much as income or market returns.

By understanding cognitive biases, recognizing emotional triggers, building disciplined systems, and avoiding common behavioral traps, you can dramatically improve your financial results—without needing to predict markets or outsmart others.

Financial success isn’t about being fearless or emotionless.

It’s about designing your financial life so emotions don’t control your decisions.

Master your behavior—and the numbers will follow.