Inflation: Unraveling the Causes and Effects on Everyday Life

Advertiser

Inflation is a term many of us hear but few fully understand. It’s crucial to grasp the **causes and effects of inflation** as it affects every aspect of our lives. From the cost of goods to business profits, it’s a force that shapes the economic landscape. Let’s dive into the world of inflation and unravel its mysteries.

Understanding Inflation: Definition and Key Concepts

In the bustling world of economics, inflation stands out as a crucial concept impacting both individuals and businesses. At its core, inflation refers to the gradual increase in prices over time, reducing purchasing power. Everyday items like groceries and gas often see steady price hikes due to inflation.

Key Concepts of Inflation

One of the primary markers of inflation is the Consumer Price Index (CPI), which tracks changes in prices of a basket of goods and services. This index helps to measure how quickly prices are rising.

Central banks, like the Federal Reserve in the U.S., play a vital role in managing inflation. They use tools like interest rates to either stimulate or cool down the economy. When inflation is high, interest rates may be increased to curb spending.

Another important aspect of inflation is the concept of purchasing power. As prices rise, the value of currency decreases, meaning each dollar buys fewer goods and services than before.

Inflation is a natural part of economic growth, but it requires careful monitoring to maintain stability. When managed well, it can indicate a healthy, growing economy. However, unchecked inflation can lead to issues like hyperinflation, where prices rise uncontrollably.

The Causes of Inflation and Their Impact on the Economy

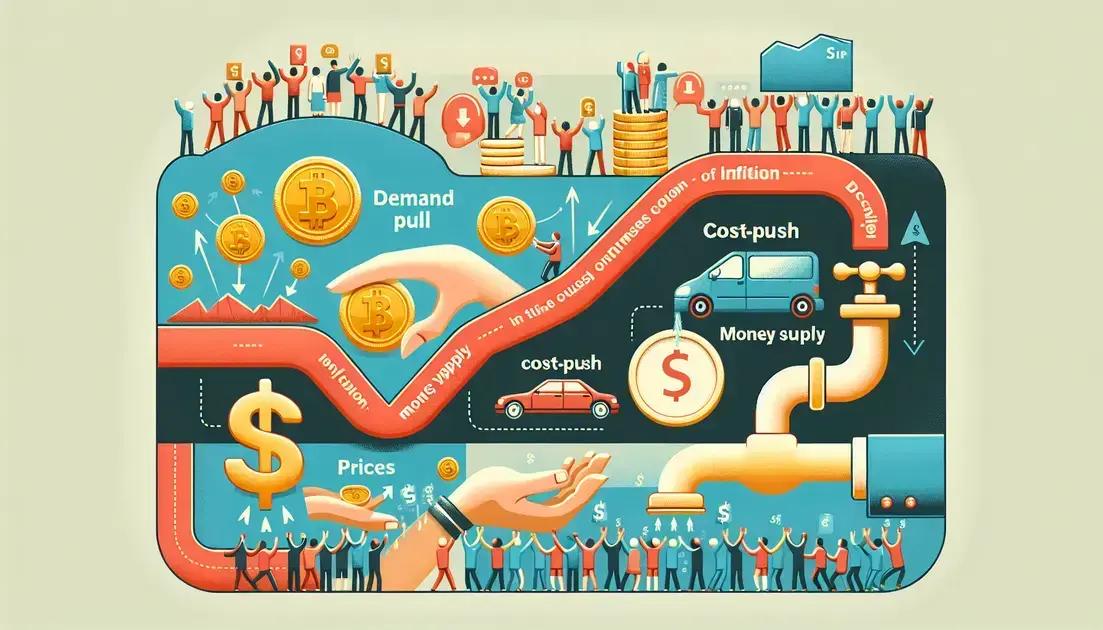

An important driver of inflation is demand-pull inflation. This occurs when demand for goods and services outpaces supply. With too much money chasing too few goods, prices climb. For example, imagine a popular new toy during the holiday season—limited stock with high demand often results in increased prices.

Cost-Push Inflation

This type of inflation happens when the cost of production rises, causing producers to increase prices. Factors like rising wages or higher raw material costs can lead to cost-push inflation. For instance, an increase in oil prices can make manufacturing and shipping more expensive, pushing prices up.

Another factor influencing inflation is the increase in money supply. When central banks print more money or lower interest rates, there is more money in the system. While this can boost economic activity, it can also create inflation if money grows faster than economic output.

The Impact of Inflation on the Economy

Inflation impacts purchasing power, making goods and services more expensive and affecting consumer spending. High inflation can also erode savings as money loses value over time. Conversely, moderate inflation is often seen as a sign of a growing economy, encouraging spending and investment.

Businesses may struggle with uncertain pricing and costs, affecting profit margins. Meanwhile, loans and interest rates fluctuate, influencing borrowing and lending behaviors. Understanding these causes helps anticipate and manage inflation’s impacts on the economy.

How Inflation Affects Consumers and Businesses

Inflation affects consumers by increasing the cost of living. Prices for everyday items such as groceries, gas, and housing tend to rise, leading people to stretch their budgets further. When wages don’t keep up with inflation, purchasing power declines, causing financial stress for many families.

Impact on Savings

For those with savings, inflation erodes the value of their money over time. If the interest on savings is less than the inflation rate, the real value of saved money decreases. This may encourage consumers to invest in assets that typically outpace inflation, such as real estate or stocks.

On businesses, inflation presents challenges in managing costs. Companies face higher expenses for materials and wages, which might lead to increased product prices. This can make it difficult to maintain profit margins and stay competitive.

Impact on Borrowing

Moreover, inflation can influence borrowing costs. When inflation is high, central banks may raise interest rates to manage it, making loans more expensive. For businesses planning to expand or invest, higher borrowing costs can affect their growth strategies.

Businesses must also deal with changes in consumer behavior. As prices rise, consumers may cut back on non-essential spending, affecting sales of luxury or discretionary items. Understanding these effects helps both consumers and businesses navigate through periods of inflation effectively.

Strategies to Cope with Inflationary Pressures

To combat inflationary pressures, consumers can adopt careful budgeting strategies. Tracking expenses and identifying areas to cut back can help manage the rising cost of living. Opting for generic brands and utilizing coupons can stretch dollars further.

Investment Options

Investing in assets that typically outpace inflation, like stocks or real estate, can preserve wealth. Diversification helps manage risk, ensuring that all investments are not adversely affected by inflation.

For businesses, reassessing pricing strategies is crucial. Understanding which products are inelastic can guide decisions on where price increases might be absorbed without losing customers. Strong supplier relationships can also provide leverage in negotiating stable supply costs.

Efficient Operations

Increasing operational efficiency is another effective strategy. Streamlining processes, reducing waste, and optimizing resource use can minimize costs and buffer the impacts of inflation.

Using technology can help businesses adjust to inflationary pressures. Automation can reduce labor costs, and data analytics can provide insights into consumer behavior, making pricing and marketing strategies more effective.

Conteúdo não disponível