Investment Opportunities: Unlocking the Secrets to Financial Success

Advertiser

**Investment** can be a game-changer in achieving financial freedom. In this article, we will explore the essential aspects of **Investment** to help you secure a prosperous future. We’ll delve into the basics, uncover various investment options, and discuss strategies to maximize your returns while highlighting common pitfalls to steer clear of.

Understanding the Basics of Investment

Investing can be an effective way to grow your wealth over time. At its core, investment involves dedicating money to specific assets or opportunities with the expectation of financial return.

The Role of Risk and Return:

All investments carry some level of risk, and understanding the risk-return ratio is crucial. Higher returns often come with higher risk, so it’s vital to assess your appetite for both.

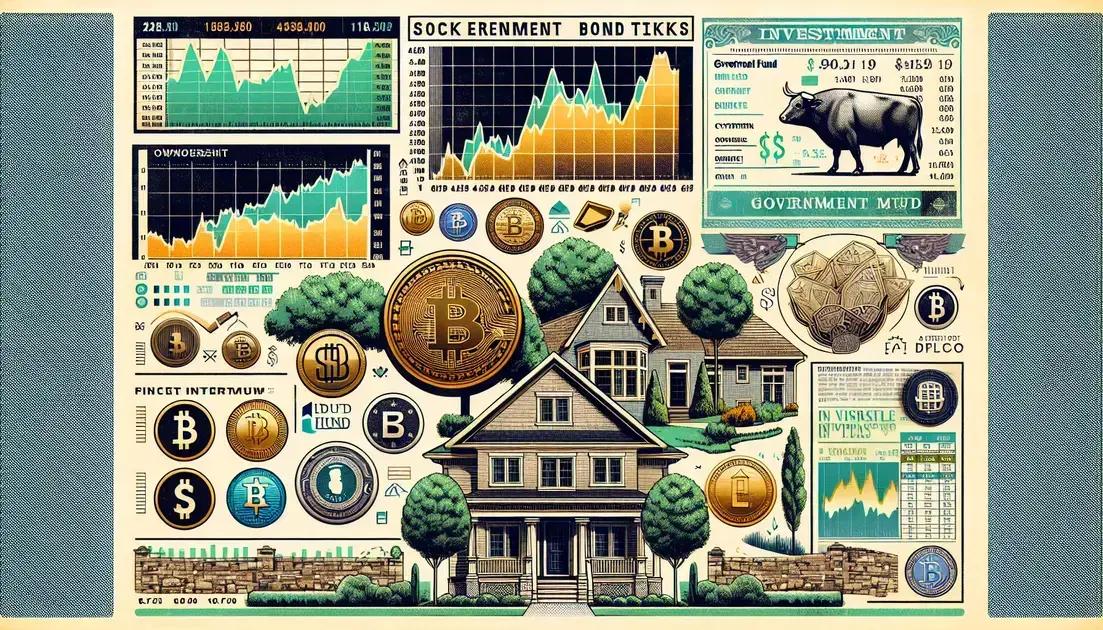

Types of Investments:

Assets such as stocks, bonds, real estate, and mutual funds are commonly traded options. Each asset class has its unique characteristics, potential returns, and associated risks.

Importance of Diversification:

Diversification, or spreading investments across different asset classes, can reduce risk. By not putting all your eggs in one basket, you can protect your portfolio from significant losses.

Setting Financial Goals:

Before investing, setting clear financial goals is essential. Are you investing for retirement, a child’s education, or a significant purchase? Knowing your goals will help shape your investment strategy.

Exploring the Different Types of Investment Options

Discovering the right investment options is key to building wealth. Each type has its features and risks.

Stocks:

Buying shares in a company means owning part of it. Stocks can offer high returns but come with risk as prices can fluctuate.

Bonds:

Bonds are loans you give to companies or governments. They typically have lower risk but also lower returns compared to stocks.

Real Estate:

Investing in property can provide rental income and potential appreciation. It requires significant initial capital and management.

Mutual Funds:

These funds pool money from many investors to buy a diverse portfolio of stocks and bonds, offering built-in diversification.

ETFs:

Exchange-Traded Funds are similar to mutual funds but trade on stock exchanges. They offer flexibility and often lower fees.

Cryptocurrencies:

Digital currencies like Bitcoin are new and volatile, appealing to those willing to accept higher risk for possible high returns.

Key Strategies to Maximize Investment Returns

Boosting your investment returns involves smart planning and informed decisions.

Diversification:

Spread your investments across various asset classes to balance risk and reward. This approach minimizes the impact of losses in any one area.

Regular Monitoring:

Keep an eye on your portfolio and make necessary adjustments. Market conditions change, and your investments should adapt accordingly.

Reinvestment:

Reinvest dividends and interest earned to accelerate growth. This compounding effect can significantly boost returns over time.

Cost Management:

Be aware of fees that can eat into your profits. Choose cost-effective investment options such as low-fee mutual funds or ETFs to maximize net returns.

Long-Term Focus:

Maintaining investments over the long haul usually reduces volatility and capitalizes on market growth. Avoid the temptation to make frequent trades.

Common Investment Mistakes and How to Avoid Them

Avoiding common investment mistakes is vital for financial success.

Lack of Research:

Relying on trends without due diligence can lead to poor decisions. Always research thoroughly before investing.

Emotional Decisions:

Acting on emotions rather than logic can cause impulsive trades. Stick to your strategy even during market volatility.

Ignoring Diversification:

Putting all your money into one investment increases risk. Diversify to protect against losses in any single area.

Timing the Market:

Attempting to predict market highs and lows is risky and often ineffective. Instead, focus on long-term growth.

Overlooking Fees:

High fees can erode returns. Opt for investment vehicles with lower costs to preserve more of your gains.

Not Setting Goals:

Investing without clear objectives can lead to missed opportunities. Define your goals to shape your strategy effectively.