Extra Income, Career, and Business in the U.S.

How to Earn More and Plan Smarter

Advertiser

In today’s economy, relying on a single source of income can be risky. Many Americans—and immigrants in the U.S.—are turning to side hustles, freelancing, and small businesses to increase income, gain flexibility, and build long-term financial security.

In this article, you’ll learn:

- How to legally create extra income in the U.S.

- The most common side hustles

- The financial impact of freelancing vs. being an employee

- How to plan finances for a small business

💼 How to Legally Create Extra Income in the U.S.

Creating extra income in the U.S. is relatively accessible, but it’s important to follow legal and tax requirements.

Key legal considerations:

- You must report all income to the IRS

- Some activities require licenses or permits

- Freelancers and contractors must pay self-employment taxes

- Keep records of income and expenses

👉 Extra income is great—but only if it doesn’t create tax or legal problems later.

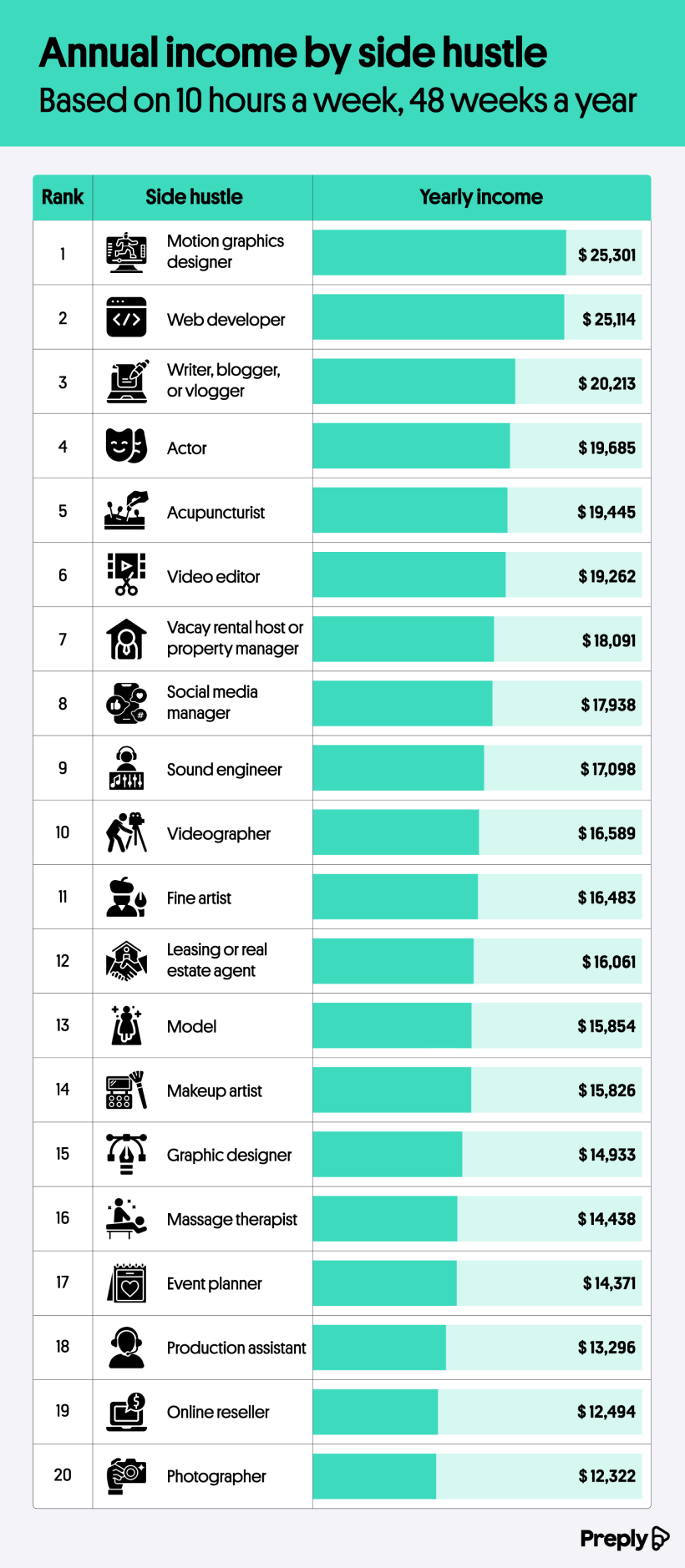

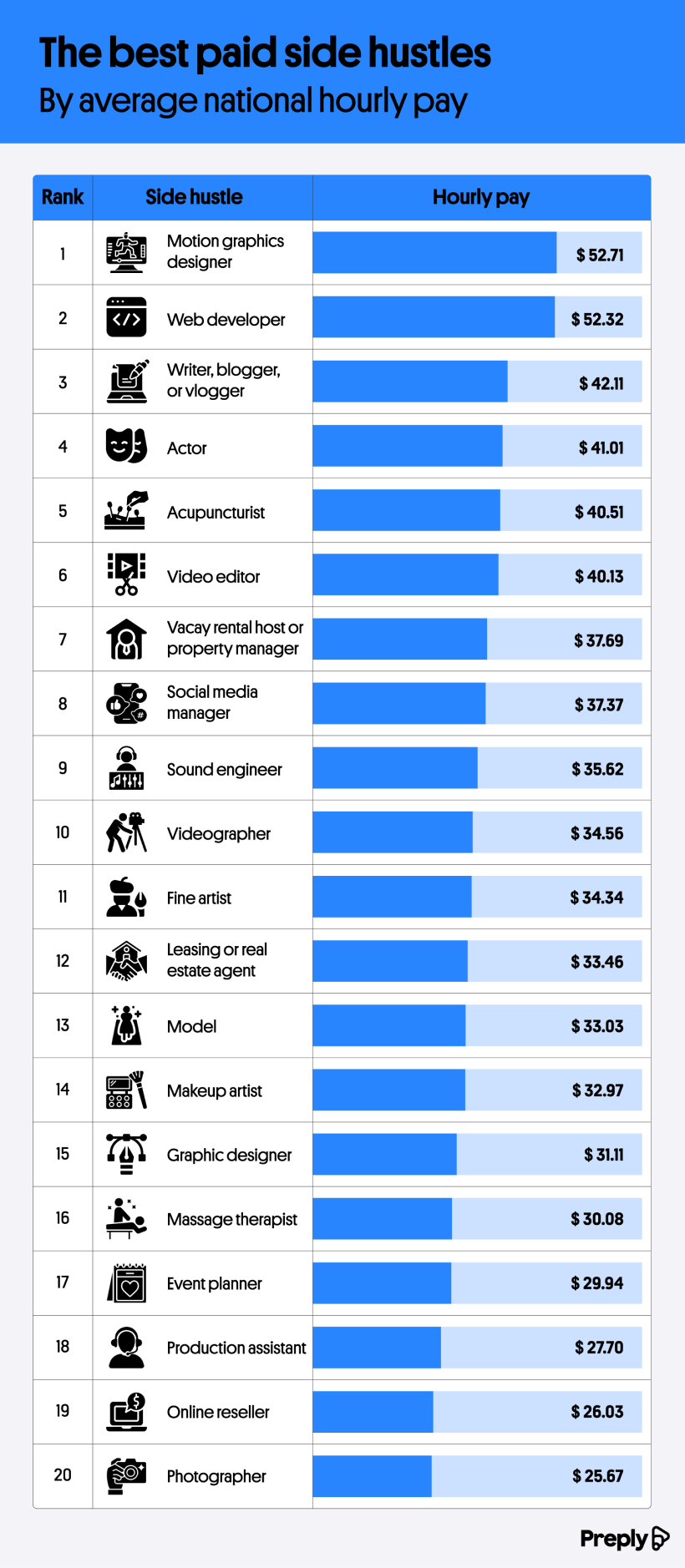

🚀 Most Common Side Hustles

Side hustles are flexible ways to earn additional income outside a traditional job.

Popular side hustles in the U.S.:

- Freelancing (design, writing, programming, marketing)

- Rideshare and delivery apps

- Online tutoring or teaching

- E-commerce and reselling

- Content creation and digital products

👉 The best side hustle matches your skills, schedule, and long-term goals.

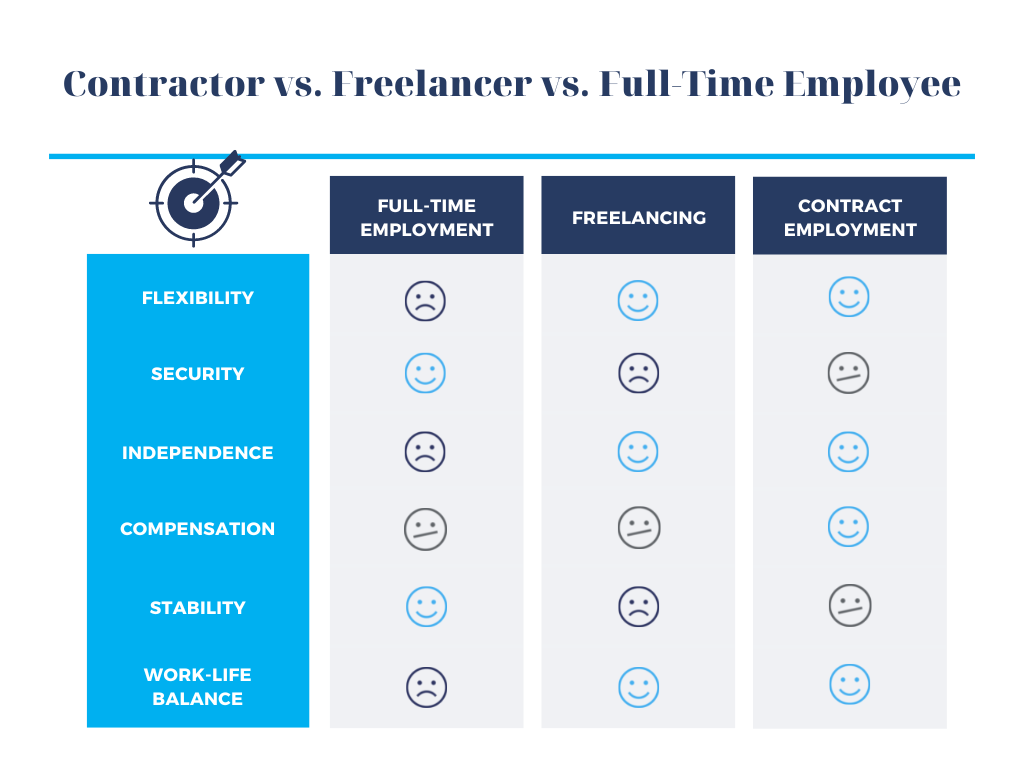

⚖️ Freelancer vs. Employee: Financial Impact

Choosing between freelancing and traditional employment has major financial implications.

Employee (W-2)

- Taxes withheld automatically

- Employer may offer benefits (health insurance, 401(k))

- Stable income

- Less flexibility

Freelancer (1099)

- Higher income potential

- More flexibility and control

- Responsible for taxes, insurance, and retirement

- Irregular income

👉 Freelancers must plan carefully to handle taxes, savings, and benefits on their own.

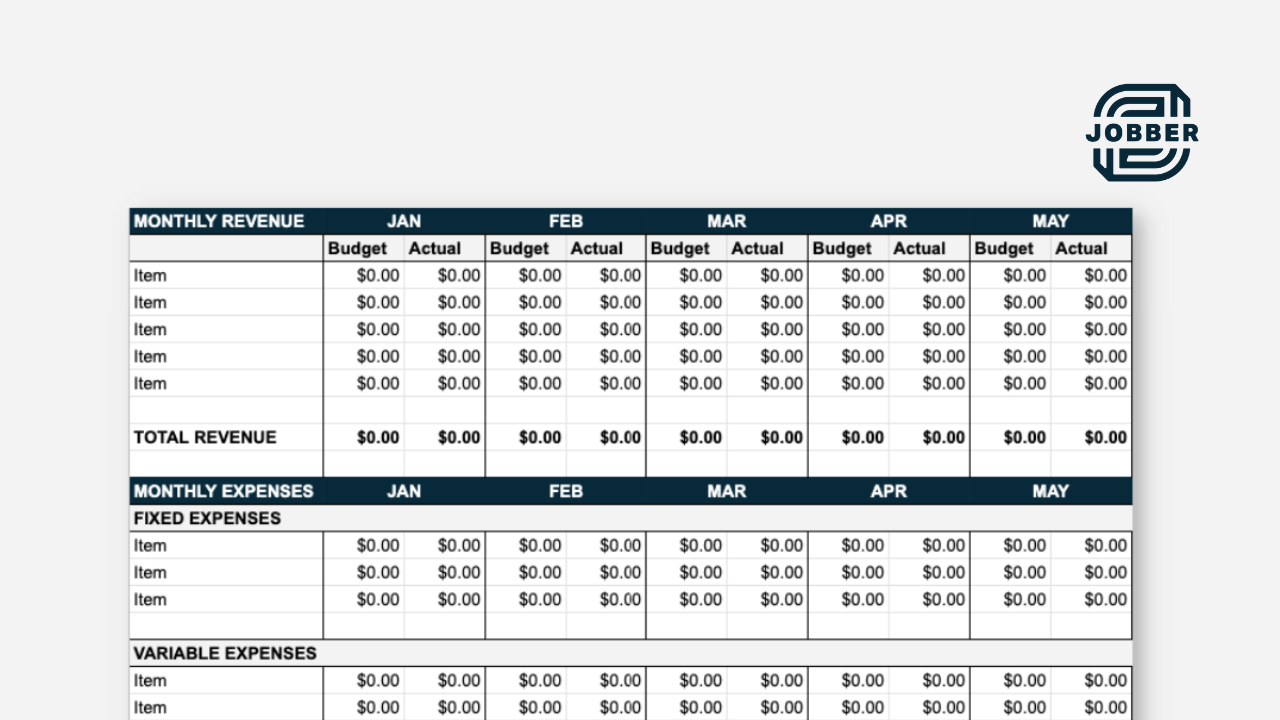

📊 Financial Planning for Small Businesses

Strong financial planning is essential for turning a side hustle into a sustainable business.

Best practices:

- Separate personal and business finances

- Open a business bank account

- Track income and expenses monthly

- Set aside money for taxes

- Build an emergency fund for the business

👉 Cash flow matters more than profit—especially in the early stages.

✅ Final Thoughts

Extra income, freelancing, and small businesses offer powerful opportunities to increase earnings and create flexibility—but success requires planning and discipline.

Understanding the financial impact of different income models, staying compliant with taxes, and managing cash flow are the keys to long-term sustainability.