Identity Theft, Fraud Prevention, and Financial Security

How to Protect Your Money in the Digital Age

Advertiser

Identity theft and financial fraud are among the fastest-growing financial threats in the United States. As more banking, shopping, and communication move online, criminals have more opportunities to exploit personal and financial information.

The good news? Most fraud can be prevented or quickly contained with the right knowledge and habits. Financial security today isn’t just about earning and saving—it’s about protecting what you already have.

In this article, you’ll learn:

The most common financial scams in the U.S.

How identity theft happens and how to prevent it

What to do if your identity is compromised

Tools that help monitor and protect your financial information

🚨 Common Financial Scams in the U.S.

Scammers constantly adapt their tactics, but most fraud falls into recognizable patterns.

Common scams to watch out for:

- Phishing scams – Fake emails or texts pretending to be banks, government agencies, or companies

- Phone scams – Calls claiming urgent problems with accounts, taxes, or benefits

- Identity impersonation – Fraudsters posing as employers, landlords, or service providers

- Online shopping scams – Fake websites or sellers offering deals that are too good to be true

- Investment scams – Promises of guaranteed or unusually high returns

- Red flags include:

- Urgent language (“act now,” “account suspended”)

- Requests for personal information

- Requests for payment via gift cards, wire transfers, or crypto

👉 If something feels rushed or threatening, pause—it’s often a scam.

🧬 How Identity Theft Happens—and How to Prevent It

Common ways identity theft happens:

- Data breaches at companies

- Weak or reused passwords

- Public Wi-Fi usage without protection

- Lost or stolen documents

- Phishing emails and fake websites

Prevention strategies that actually work:

- Use strong, unique passwords for each account

- Enable two-factor authentication (2FA)

- Avoid clicking unknown links or attachments

- Shred sensitive documents

- Secure your mailbox and digital devices

👉 Identity theft prevention is about layers of protection, not a single tool.

Check out this content now: Mental Health, Stress, and Money Management

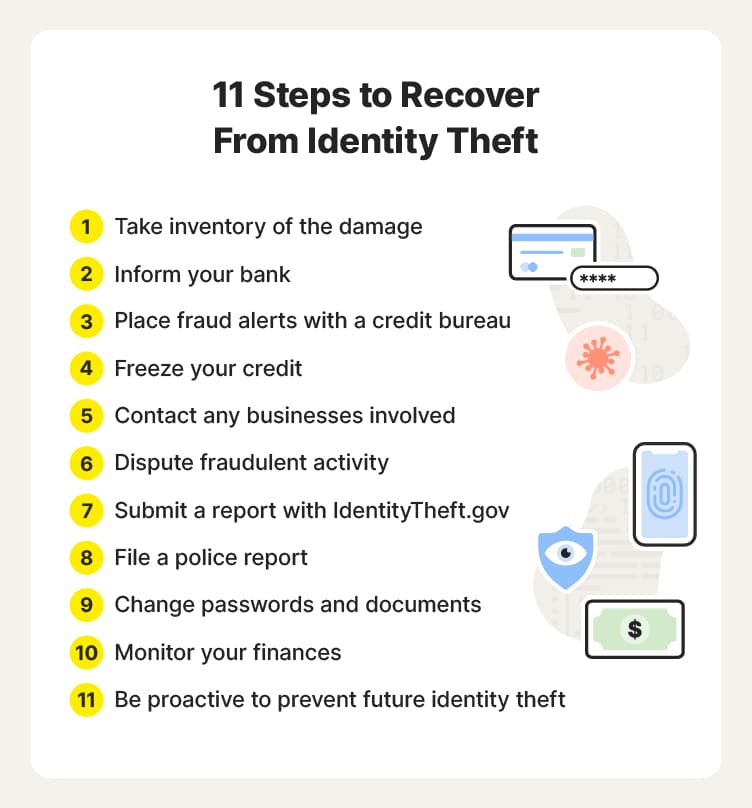

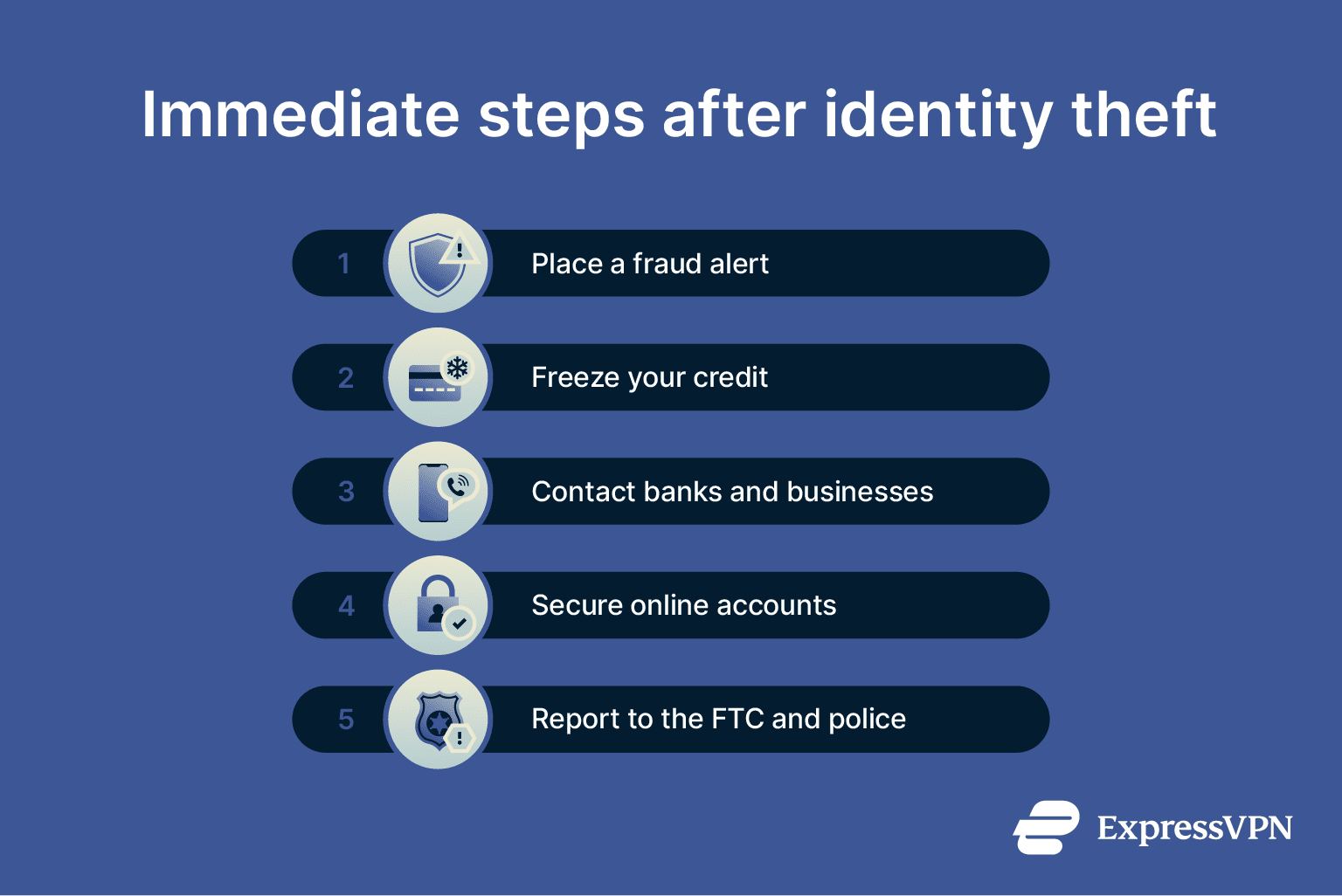

🛑 What to Do If Your Identity Is Compromised

If identity theft happens, speed matters. Acting quickly can limit financial damage and protect your credit.

Immediate steps to take:

- Freeze your credit with all three credit bureaus

- Change passwords on affected accounts

- Contact banks and creditors to report fraud

- Review recent transactions carefully

- File an identity theft report with the appropriate authorities

Follow-up actions:

- Monitor credit reports regularly

- Dispute fraudulent accounts or charges

- Keep records of all communications

- Consider fraud alerts or identity monitoring

👉 Identity theft is stressful—but it’s recoverable with decisive action.

🔍 Tools to Monitor and Protect Your Financial Information

Modern financial security relies on proactive monitoring, not just reacting after fraud occurs.

Helpful protection tools:

- Credit monitoring services – Alert you to new accounts or credit changes

- Fraud alerts – Extra verification before new credit is opened

- Account alerts – Real-time notifications for transactions

- Password managers – Secure storage for strong passwords

- Credit freezes – Prevent unauthorized credit applications

Many banks and credit card companies now offer:

- Free credit score tracking

- Transaction alerts

- Zero-liability fraud protection

👉 Use the tools available—you’re often already paying for them through your financial institutions.

🧠 Financial Security as a Long-Term Habit

Smart security habits include:

- Reviewing bank and credit card statements monthly

- Updating passwords regularly

- Limiting the personal information you share online

- Checking credit reports at least annually

- Treating unexpected financial messages with skepticism

People who actively monitor their finances are far more likely to catch fraud early—before major damage occurs.

🛡️ Why Financial Security Is Part of Financial Planning

Fraud and identity theft don’t just cost money—they:

- Damage credit scores

- Delay financial goals

- Increase stress and uncertainty

- Consume time and emotional energy

Protecting your financial information is just as important as:

- Budgeting

- Investing

- Saving for retirement

👉 A strong financial plan includes protection, not just growth.

✅ Final Thoughts

In today’s digital economy, financial security is a responsibility—not a luxury. Identity theft and fraud can happen to anyone, but the impact is far smaller for those who are informed, prepared, and proactive.

By understanding common scams, preventing identity theft, knowing how to respond quickly, and using modern protection tools, you can dramatically reduce risk and protect your financial future.

You work hard for your money.

Protecting it is part of owning it.