Insurance and Financial Protection in the U.S

What You Need to Know

Advertiser

Insurance plays a critical role in financial stability in the United States. Medical emergencies, car accidents, or unexpected life events can quickly become financial disasters without proper coverage. Understanding how insurance works—and choosing the right policies—helps protect both your finances and your family’s future.

In this article, you’ll learn:

- The most important types of insurance in the U.S.

- How health insurance works

- Auto insurance: minimum vs. full coverage

- When life insurance is worth it

🛡️ Most Important Types of Insurance in the U.S.

While there are many types of insurance available, some are considered essential for most people living in the U.S.

Key insurance types:

- Health insurance – Covers medical expenses

- Auto insurance – Required by law in most states

- Renters or homeowners insurance – Protects property and liability

- Life insurance – Provides financial support to dependents

- Disability insurance – Replaces income if you can’t work

👉 Insurance is not about predicting problems—it’s about being financially prepared when they happen.

Read also: Real Estate and Wealth Building in the U.S.

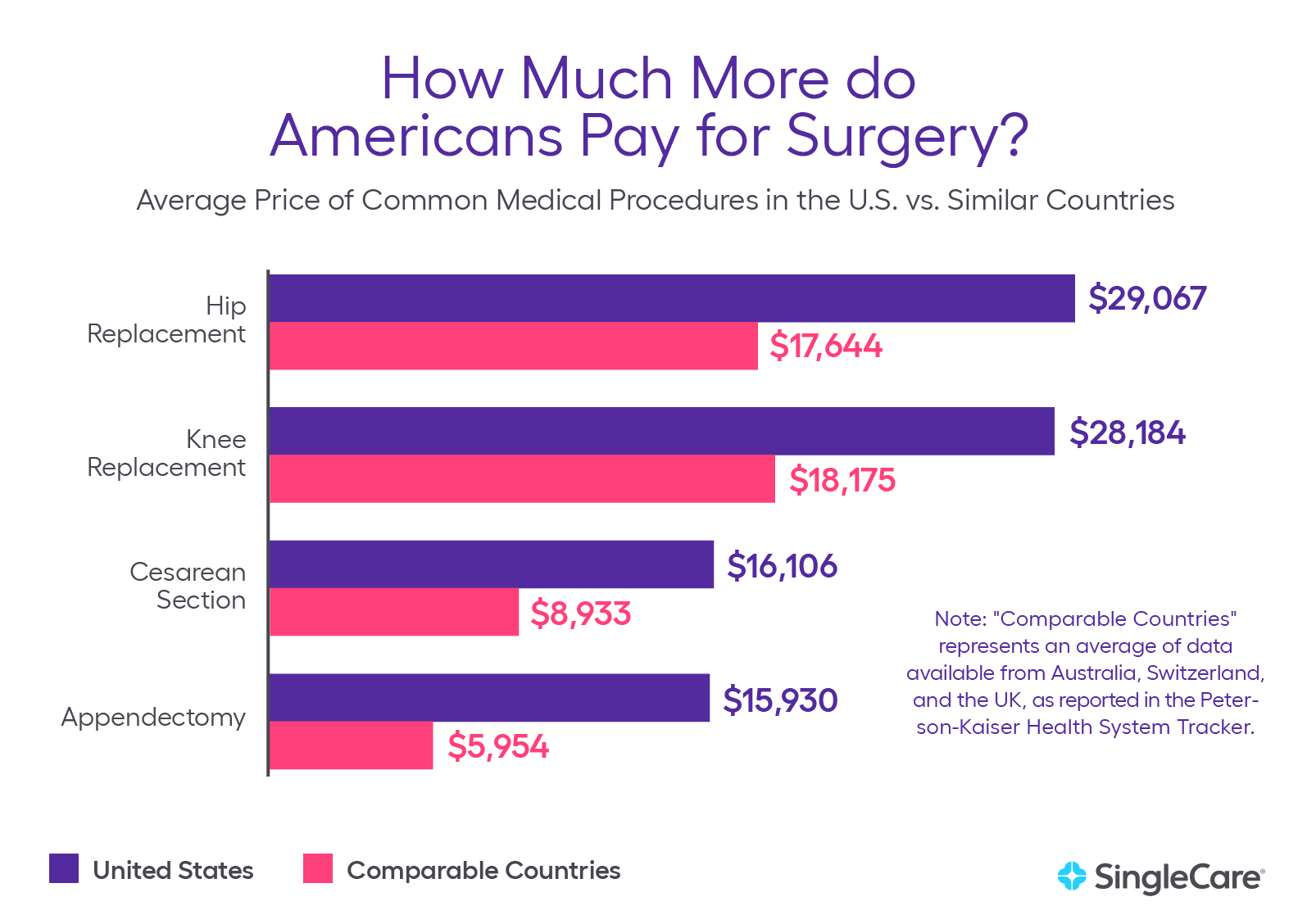

🏥 How Health Insurance Works in the U.S.

Health insurance in the U.S. is complex and often confusing, but understanding the basics can save you thousands of dollars.

Common health insurance terms:

- Premium – Monthly payment for coverage

- Deductible – Amount you pay before insurance starts covering costs

- Copay – Fixed amount for services (doctor visits, prescriptions)

- Coinsurance – Percentage you pay after meeting the deductible

- Out-of-pocket maximum – The most you’ll pay in a year

Health insurance is typically obtained through:

- Employers

- Government programs

- The Health Insurance Marketplace

👉 Without insurance, medical bills can become overwhelming—even for routine care.

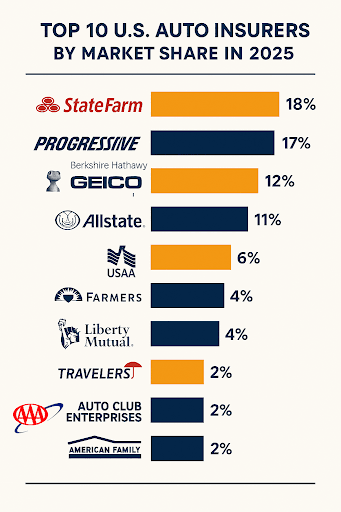

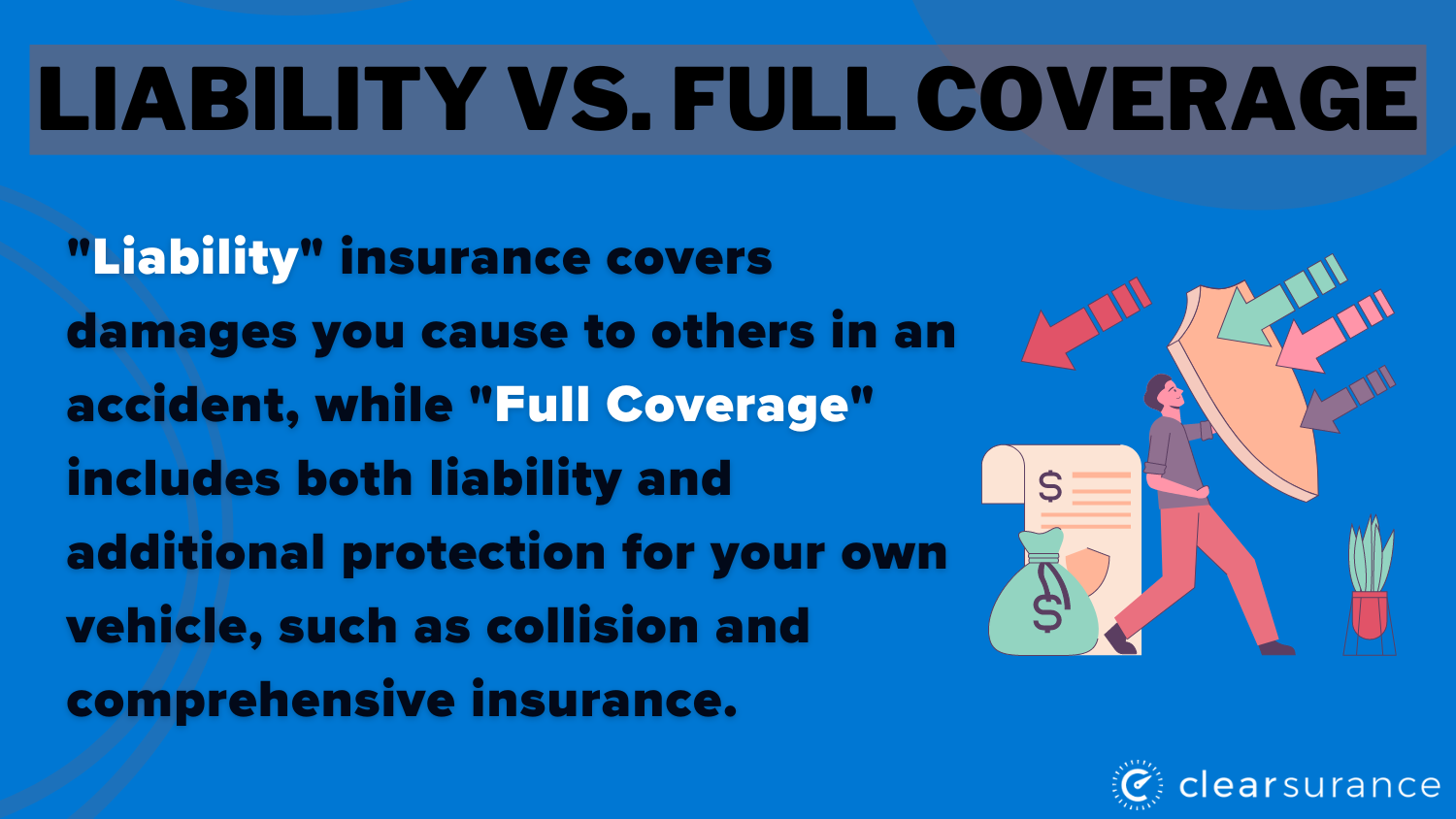

🚗 Auto Insurance: Minimum vs. Full Coverage

Auto insurance is mandatory in most U.S. states, but coverage levels vary.

Minimum coverage:

- Covers damage or injury you cause to others

- Meets legal requirements

- Lower monthly premiums

- Does not cover your own vehicle repairs

Full coverage:

- Includes liability, collision, and comprehensive insurance

- Covers your car in accidents, theft, vandalism, and weather events

- Higher premiums, but stronger financial protection

👉 Full coverage is often required if your car is financed or leased.

❤️ Life Insurance: When Is It Worth It?

Life insurance is designed to protect those who depend on your income—not you.

Life insurance may be worth it if you:

- Have dependents (children or spouse)

- Have a mortgage or significant debt

- Want to cover funeral and final expenses

- Want to replace lost income

Common types:

- Term life insurance – Coverage for a specific period (most affordable)

- Permanent life insurance – Lifetime coverage with investment components

👉 For most people, term life insurance provides the best value and simplicity.

✅ Final Thoughts

Insurance is a cornerstone of financial protection in the United States. While it may feel like an extra expense, the right coverage can prevent long-term financial hardship and provide peace of mind.

The key is balance: protect yourself against major risks without overpaying for unnecessary coverage.