Long-Term Care Planning and Aging Costs

How to Prepare Financially for Later Life

Advertiser

Long-term care is one of the largest and most underestimated financial risks facing Americans. As life expectancy increases, so does the likelihood that individuals or their loved ones will need some form of long-term care—often for years, not months.

Without proper planning, long-term care costs can quickly drain retirement savings, create stress for families, and force difficult financial decisions. The good news is that early and informed planning can dramatically reduce the impact.

In this article, you’ll learn:

- The true cost of long-term care in the U.S.

- How long-term care insurance works

- How to plan financially for aging parents

- Strategies to protect retirement savings from care costs

🏥 The Cost of Long-Term Care in the U.S.

Long-term care includes services that help people with daily activities such as bathing, dressing, eating, and mobility. These services are not typically covered by regular health insurance or Medicare.

Common types of long-term care and costs:

- In-home care: Often charged hourly and can add up quickly

- Assisted living facilities: Monthly fees for housing, meals, and personal care

- Nursing homes: The most expensive option, offering 24/7 medical supervision

- Costs vary widely by state, but nationwide averages are high—and rising every year.

Why these costs matter:

- Care may be needed for several years

- Inflation increases healthcare costs faster than general inflation

- Couples may face overlapping care needs

👉 Long-term care isn’t a rare scenario—it’s a common life event that deserves planning.

🛡️ Long-Term Care Insurance Explained

Long-term care insurance (LTCI) is designed to help cover the cost of extended care services.

What long-term care insurance typically covers:

- In-home care

- Assisted living

- Nursing home care

- Adult day care services

Key features to understand:

- Daily or monthly benefit amount

- Benefit period (e.g., 2 years, 5 years, or lifetime)

- Elimination period (waiting period before benefits begin)

- Inflation protection

When does LTC insurance make sense?

- For people with moderate to high assets

- For those who want to protect retirement savings

- When purchased earlier (typically in your 50s or early 60s)

👉 Long-term care insurance isn’t for everyone, but for the right household, it can be a powerful risk-management tool.

👨👩👧 Planning for Aging Parents

Many adults find themselves supporting aging parents—financially, emotionally, or both—often with little preparation.

Important planning conversations to have:

- What care preferences do they have?

- What assets and insurance coverage exist?

- Who will make medical and financial decisions if needed?

- Are legal documents in place?

Key documents to review:

- Power of attorney (financial and healthcare)

- Living will or advance healthcare directive

- Updated beneficiary designations

Financial considerations:

- Will family members contribute to care costs?

- Can parents afford care independently?

- Will caregiving affect your own income or retirement plans?

👉 Planning ahead reduces crisis-driven decisions and family conflict later.

🧓 Protecting Retirement Savings From Care Costs

One of the biggest fears retirees face is outliving their savings due to healthcare or long-term care expenses.

Strategies to protect retirement assets:

1. Build healthcare costs into retirement projections

- Retirement planning should include:

- Rising healthcare premiums

- Out-of-pocket medical costs

- Potential long-term care needs

2. Use insurance strategically

Insurance can help transfer part of the financial risk away from personal savings.

3. Maintain flexibility in withdrawal strategies

Rigid withdrawal plans may not survive large, unexpected expenses.

4. Avoid over-optimistic assumptions

Planning only for “best-case” scenarios leaves little margin for error.

👉 Protecting retirement savings isn’t about fear—it’s about realism.

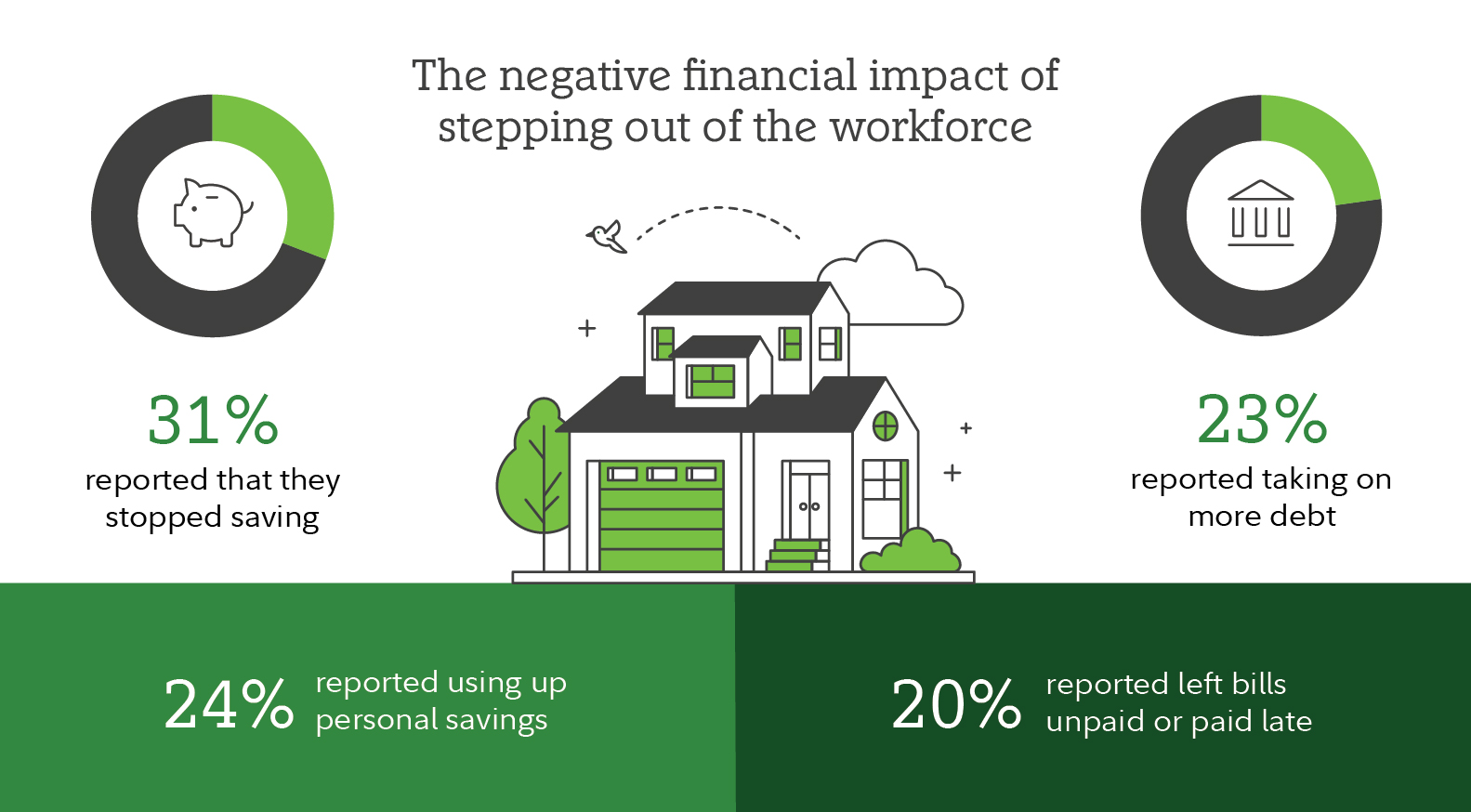

🧠 Long-Term Care as a Family Financial Issue

Long-term care rarely affects just one person. It often impacts:

- Spouses

- Adult children

- Grandchildren

- Caregivers’ careers and finances

Caregiving can reduce:

- Household income

- Retirement contributions

- Career advancement

👉 Financial planning should account for both direct care costs and indirect family impacts.

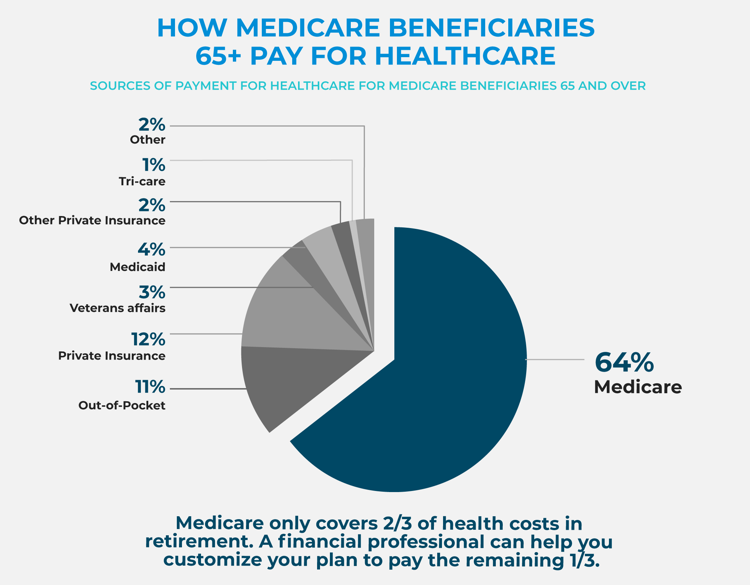

📊 Medicare, Medicaid, and Long-Term Care

Many people assume Medicare will cover long-term care—but this is a common misunderstanding.

Key distinctions:

- Medicare covers short-term skilled care, not long-term custodial care

- Medicaid can cover long-term care, but only after strict asset and income limits are met

Relying on Medicaid often requires:

- Spending down assets

- Limited choice of care facilities

👉 Government programs are safety nets—not comprehensive solutions.

🧩 Building a Long-Term Care Plan

A strong long-term care plan includes:

- Understanding potential costs

- Evaluating insurance options

- Coordinating family expectations

- Integrating care planning into retirement strategy

- Reviewing plans regularly as health and finances change

The earlier planning begins, the more options and control you retain.

✅ Final Thoughts

Long-term care planning is one of the most important—and emotionally challenging—parts of financial planning. Ignoring it doesn’t reduce the risk; it simply transfers the burden to loved ones and future you.

By understanding the true costs of care, considering insurance thoughtfully, planning for aging parents, and protecting retirement savings, you can face the future with greater confidence and flexibility.

Long-term care planning isn’t about expecting the worst.

It’s about being prepared for reality—and protecting the people and resources you care about most.