Long-Term Care Planning and Aging Costs

How to Prepare Financially for the Later Stages of Life

Advertiser

Long-term care is one of the most significant—and least planned for—financial challenges facing Americans today. As life expectancy increases, so does the likelihood that individuals or their loved ones will require assistance with daily living at some point. Yet many families delay planning for long-term care until a crisis occurs, often resulting in emotional stress and severe financial consequences.

Long-term care planning is not only about aging—it’s about protecting retirement savings, preserving independence, and reducing the burden on family members. Understanding the costs, insurance options, and planning strategies can make a meaningful difference in long-term financial security.

In this article, we’ll explore:

- The true cost of long-term care in the U.S.

- How long-term care insurance works

- How to plan financially for aging parents

- Ways to protect retirement savings from care-related expenses

🏥 The Cost of Long-Term Care in the U.S.

Long-term care includes services that help individuals with activities of daily living such as bathing, dressing, eating, mobility, and cognitive support. These services are typically required due to aging, chronic illness, injury, or conditions like dementia.

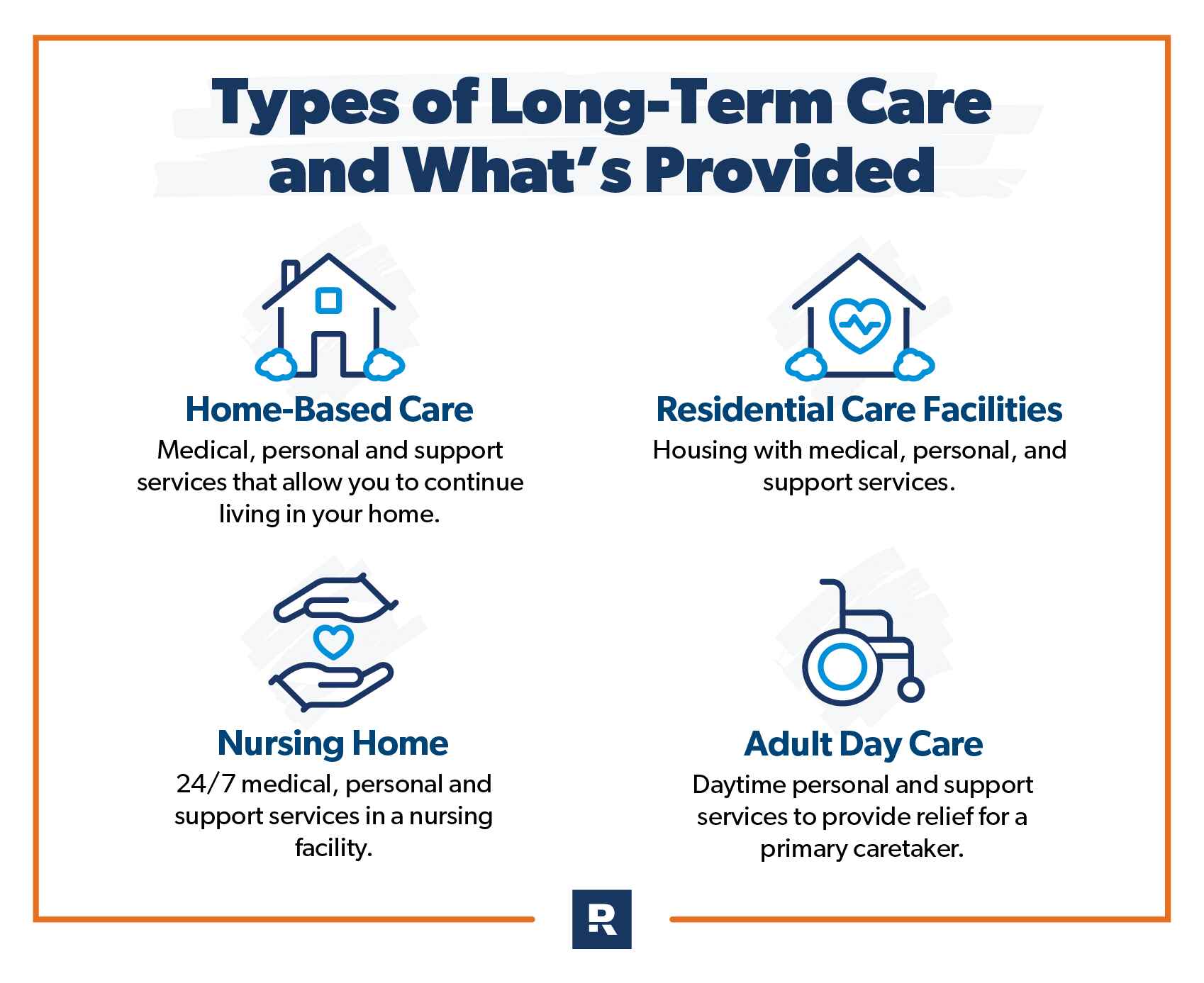

Common types of long-term care:

- In-home care, provided by aides or nurses in a private residence

- Assisted living facilities, offering housing plus personal care services

- Nursing homes, which provide 24/7 medical and custodial care

The costs associated with these services are substantial and vary widely by location. In many states, assisted living can cost several thousand dollars per month, while nursing home care can exceed six figures annually.

What makes long-term care especially challenging is that:

- Care is often needed for multiple years

- Costs rise faster than general inflation

- Traditional health insurance and Medicare offer limited coverage

👉 Without planning, even well-funded retirement accounts can be depleted quickly.

🛡️ Long-Term Care Insurance Explained

Long-term care insurance (LTCI) is designed to help cover care costs that standard health insurance does not. While not suitable for everyone, it can be an effective risk-management tool for certain households.

What long-term care insurance typically covers:

- In-home care services

- Assisted living facilities

- Nursing home care

- Adult day care programs

Key policy features to understand:

- Daily or monthly benefit amount – how much the policy pays

- Benefit period – how long benefits last (e.g., 3 years, 5 years)

- Elimination period – the waiting period before benefits begin

- Inflation protection – critical for maintaining purchasing power

Long-term care insurance is generally more affordable and easier to qualify for when purchased earlier, often in a person’s 50s or early 60s.

👉 LTC insurance doesn’t eliminate risk—it helps share and manage it, protecting personal assets from catastrophic care costs.

👨👩👧 Planning for Aging Parents

Many adults become caregivers for aging parents with little warning. Without preparation, families are forced into decisions under pressure, often without a clear understanding of finances or care preferences.

Important conversations to have early:

- What type of care do parents prefer if needed?

- What assets, savings, or insurance policies are available?

- Who will make financial and medical decisions if parents are unable to do so?

- How much support can family members realistically provide?

Essential legal documents to review:

- Financial power of attorney

- Healthcare power of attorney

- Living will or advance directive

- Updated beneficiary designations

Caring for aging parents often has a direct financial impact on adult children, including reduced work hours, lost income, and delayed retirement contributions.

👉 Proactive planning helps protect both generations’ financial futures.

🧓 Protecting Retirement Savings From Care Costs

One of the greatest fears retirees face is outliving their savings due to healthcare or long-term care expenses. This risk increases significantly without proper planning.

Strategies to protect retirement assets:

1. Include care costs in retirement projections

Retirement planning should account for:

- Rising healthcare premiums

- Out-of-pocket medical expenses

- Potential long-term care needs

Ignoring these costs can create overly optimistic projections.

2. Use insurance strategically

Long-term care insurance or hybrid insurance products can help prevent large care expenses from draining investment portfolios.

3. Maintain flexible withdrawal strategies

Rigid withdrawal plans may fail when unexpected care costs arise. Flexibility allows retirees to adjust spending without jeopardizing long-term sustainability.

4. Preserve liquidity

Having accessible funds helps manage care costs without forcing the sale of long-term investments during market downturns.

👉 Retirement planning without long-term care planning is incomplete.

🧠 Medicare, Medicaid, and the Reality of Long-Term Care

A common misconception is that Medicare covers long-term care. In reality:

- Medicare only covers short-term skilled care following hospitalization

- Medicaid can cover long-term care, but only after strict income and asset limits are met

Qualifying for Medicaid often requires individuals to spend down assets, significantly reducing financial flexibility and limiting care options.

👉 Government programs act as safety nets, not comprehensive long-term care solutions.

🧩 Long-Term Care as a Family Financial Issue

Long-term care decisions rarely affect just one person. They often involve spouses, adult children, and caregivers, creating ripple effects throughout the family.

Financial and emotional impacts may include:

- Increased household expenses

- Reduced income for caregivers

- Career interruptions

- Heightened stress and burnout

Clear communication, defined roles, and shared expectations can significantly improve outcomes for everyone involved.

🛡️ Building a Long-Term Care Plan

A comprehensive long-term care plan should include:

- Understanding potential care costs

- Evaluating insurance and savings options

- Coordinating family responsibilities

- Integrating care planning into retirement strategy

- Reviewing plans regularly as health and finances change

The earlier planning begins, the more options—and control—you maintain.

✅ Final Thoughts

Long-term care planning is one of the most important yet emotionally complex areas of personal finance. Ignoring it doesn’t reduce the risk—it simply shifts the burden to loved ones and future you.

By understanding the cost of care, evaluating long-term care insurance, planning for aging parents, and protecting retirement savings, individuals and families can approach later life with confidence, dignity, and financial resilience.

Long-term care planning isn’t about expecting the worst.

It’s about preparing for reality—and protecting the people and resources that matter most.