Retirement and Financial Independence (FIRE)

A Modern Approach to Financial Freedom

Advertiser

Retirement in the United States is no longer just about stopping work at age 65. For many people, it’s about freedom, flexibility, and control over time. That’s where the FIRE movement — Financial Independence, Retire Early — comes in.

In this article, we’ll cover:

- What the FIRE movement is and how it works

- How much money you need to retire in the U.S.

- Traditional retirement vs. financial independence

- Common retirement planning mistakes to avoid

🔥 What Is the FIRE Movement?

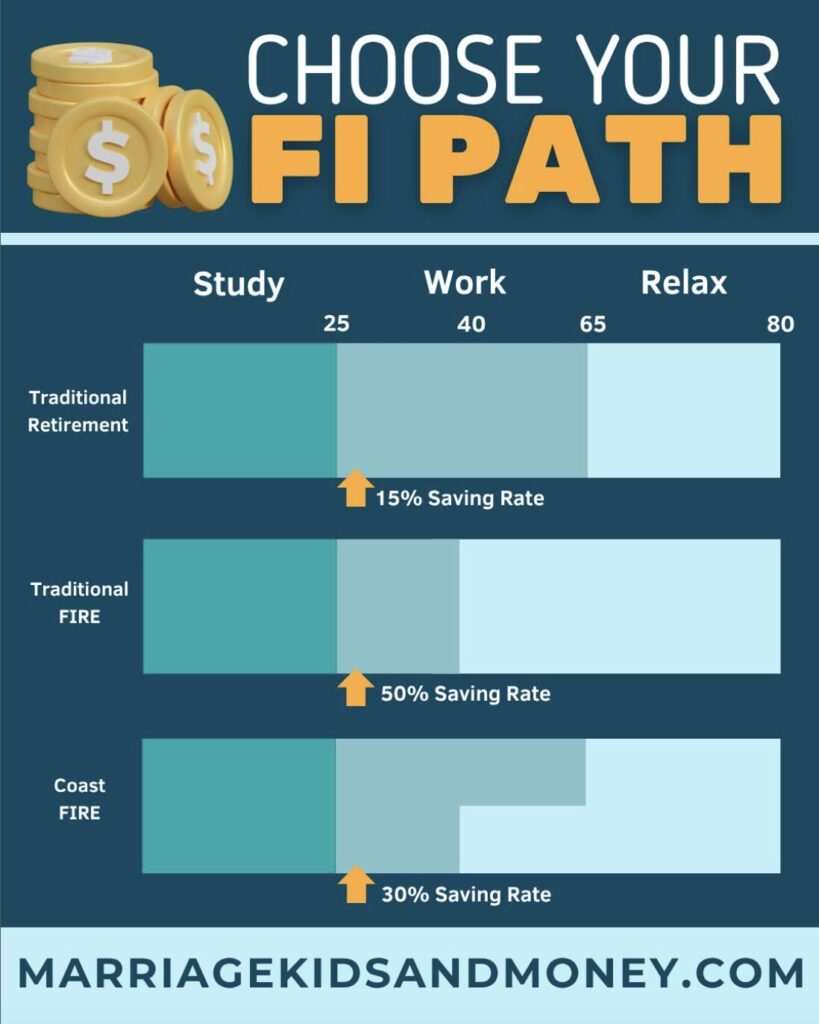

The FIRE movement focuses on aggressively saving and investing in order to reach financial independence as early as possible. Financial independence means your investments generate enough income to cover your living expenses—without relying on a paycheck.

Core principles of FIRE:

- High savings rate (often 40–70% of income)

- Intentional spending and lifestyle choices

- Long-term investing, typically in low-cost index funds

- Focus on assets that produce passive income

There are different variations, such as Lean FIRE, Fat FIRE, and Coast FIRE, allowing people to tailor the approach to their desired lifestyle.

💰 How Much Money Do You Need to Retire in the U.S.?

The amount you need to retire depends on your lifestyle, location, and healthcare costs. A common FIRE guideline is the 4% rule.

The 4% rule explained:

- You can withdraw about 4% of your portfolio per year

- Your savings should equal 25 times your annual expenses

Example:

If you spend $50,000 per year, you’d need roughly $1.25 million invested.

Read also: Budgeting and Money Management

Factors that affect your retirement number:

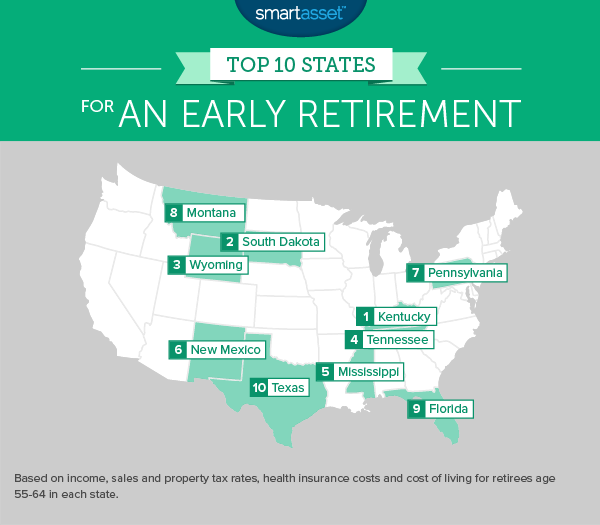

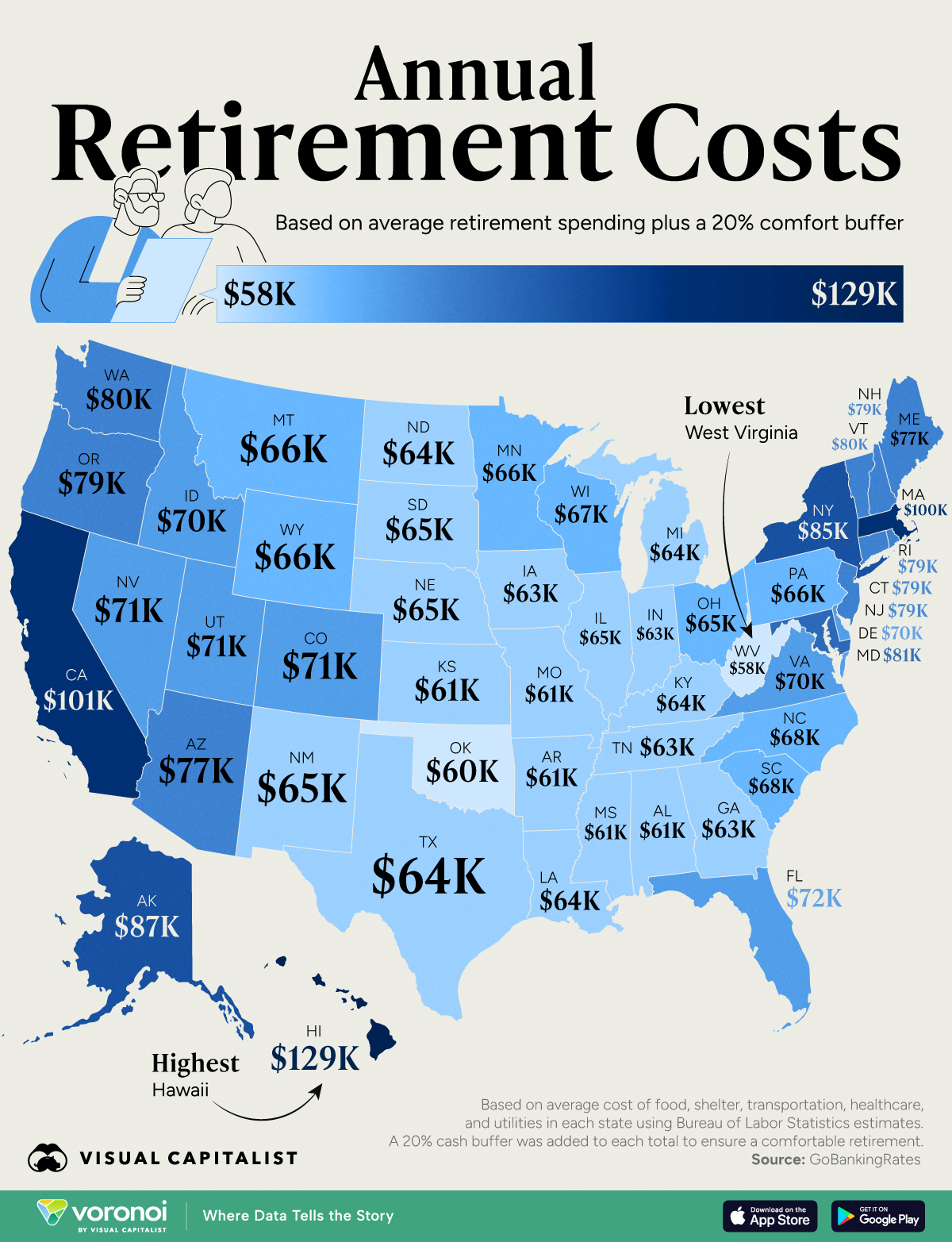

- Cost of living (housing, taxes, healthcare)

- Inflation

- Life expectancy

- Health insurance before Medicare eligibility

👉 Retirement isn’t about a magic number—it’s about sustainable income.

⚖️ Traditional Retirement vs. Financial Independence

Traditional Retirement

- Work until age 60–67

- Rely on 401(k), pensions, and Social Security

- Gradual savings over decades

- Retirement starts later in life

Financial Independence (FIRE)

- Focus on freedom, not age

- Heavy saving and investing early

- Optional work once financially independent

- More flexibility and lifestyle choice

👉 FIRE doesn’t mean never working again—it means work becomes optional.

🚫 Common Retirement Planning Mistakes

Even high earners can struggle in retirement due to poor planning. Some of the most common mistakes include:

❌ Starting too late

❌ Underestimating healthcare costs

❌ Relying solely on Social Security

❌ Not adjusting for inflation

❌ Investing too conservatively too early

❌ Lacking a clear withdrawal strategy

Avoiding these mistakes early can dramatically improve long-term outcomes.

✅ Final Thoughts

Retirement and financial independence are not one-size-fits-all goals. Whether you pursue the FIRE movement or follow a more traditional path, the key is intentional planning, disciplined investing, and clarity about your lifestyle goals.

The earlier you start, the more powerful compound growth becomes—and the more options you’ll have in the future.